Your Collin county real estate taxes images are available. Collin county real estate taxes are a topic that is being searched for and liked by netizens now. You can Download the Collin county real estate taxes files here. Find and Download all free photos and vectors.

If you’re searching for collin county real estate taxes pictures information linked to the collin county real estate taxes keyword, you have visit the right site. Our site always provides you with suggestions for seeking the maximum quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

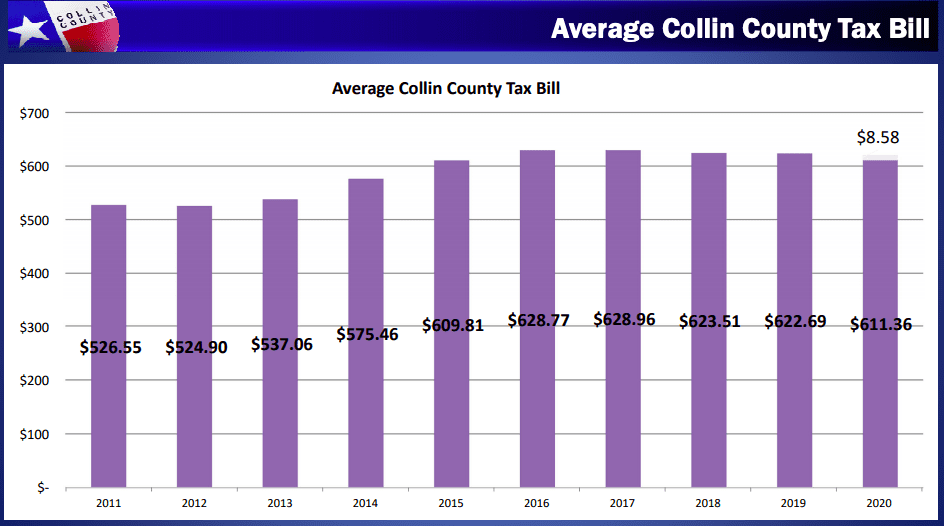

Collin County Real Estate Taxes. The median property tax also known as real estate tax in Collin County is 435100 per year based on a median home value of 19900000 and a median effective property tax rate of 219 of property value. For a faster search. Penalty is imposed at the statutory rate of 6 on the first day of the delinquency month and will increase 1 on the first day each month thereafter reaching 12 maximum by July 1. Welcome to Collin County Texas Online.

Collin County Texas Property Search And Interactive Gis Map From taxnetusa.com

Collin County Texas Property Search And Interactive Gis Map From taxnetusa.com

Median real estate property taxes paid for housing units with no mortgage in 2019. But the regions roots have a rich storied past with pioneer hardships and even a little Old West gunplay that hasnt been completely buried with new development. 181 of home value. XXXXXXXXXXXXX Enter owner. If you do not know the account number try Example. These records can include Collin County property tax assessments and assessment challenges appraisals and income taxes.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Account Number Account numbers can be found on your Tax Statement. Online Taxes Account Search. Collin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Collin County Texas. - 5 pm 8 a. Yearly median tax in Collin County The median property tax in Collin County Texas is 4351 per year for a home worth the median value of 199000. Discover short videos related to collin county property taxes on TikTok.

These records can include Collin County property tax assessments and assessment challenges appraisals and income taxes. Estimates assume average property tax rate of 22 and the state average reduction of 52 due to data inconsistencies in underlying county data. For a faster search. Collin County Property Taxes become delinquent on February 1. - 5 pm 8 a.

Source: frisco.com

Source: frisco.com

Watch popular content from the following creators. User104622708004 tayterth Learn Commercial Real Estate realestatesource RJ Pepino therealrjpepino Tom Cruz tcruznc Thevaluer thevaluer. 181 of home value. Discover short videos related to collin county property taxes on TikTok. Yearly median tax in Collin County The median property tax in Collin County Texas is 4351 per year for a home worth the median value of 199000.

Source: dfwurbanrealty.com

Source: dfwurbanrealty.com

Discover short videos related to collin county property taxes on TikTok. User104622708004 tayterth Learn Commercial Real Estate realestatesource RJ Pepino therealrjpepino Tom Cruz tcruznc Thevaluer thevaluer. Discover short videos related to collin county property taxes on TikTok. Thats higher than Travis County and the states overall average of 183 but lower than counties like Tarrant Harris Bexar and Dallas. Any No HOA Fee 50month100month200month300.

Source: taxpublic.collincountytx.gov

Source: taxpublic.collincountytx.gov

5768 17 Percentage of residents living in poverty in 2019. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Penalty is imposed at the statutory rate of 6 on the first day of the delinquency month and will increase 1 on the first day each month thereafter reaching 12 maximum by July 1. These records can include Collin County property tax assessments and assessment challenges appraisals and income taxes. Estimates assume average property tax rate of 22 and the state average reduction of 52 due to data inconsistencies in underlying county data.

User104622708004 tayterth Learn Commercial Real Estate realestatesource RJ Pepino therealrjpepino Tom Cruz tcruznc Thevaluer thevaluer. Collin County Tax Assessor-Collector McKinney Office Collin County Administration Building 2300 Bloomdale Rd Suite 2324 McKinney TX 75071 Map propertytaxcollincountytxgov 972-547-5020 Hours. Discover short videos related to collin county property taxes on TikTok. Watch popular content from the following creators. Collin County Property Records are real estate documents that contain information related to real property in Collin County Texas.

Source: kevindcampbell.ca

Source: kevindcampbell.ca

Why choose Home Tax Shield. E-mail your question to. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Collin County Property Records are real estate documents that contain information related to real property in Collin County Texas. Estimates assume average property tax rate of 22 and the state average reduction of 52 due to data inconsistencies in underlying county data.

Source: electscottgrigg.com

Source: electscottgrigg.com

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Why choose Home Tax Shield. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Still cant find the answer. Median real estate property taxes paid for housing units with no mortgage in 2019.

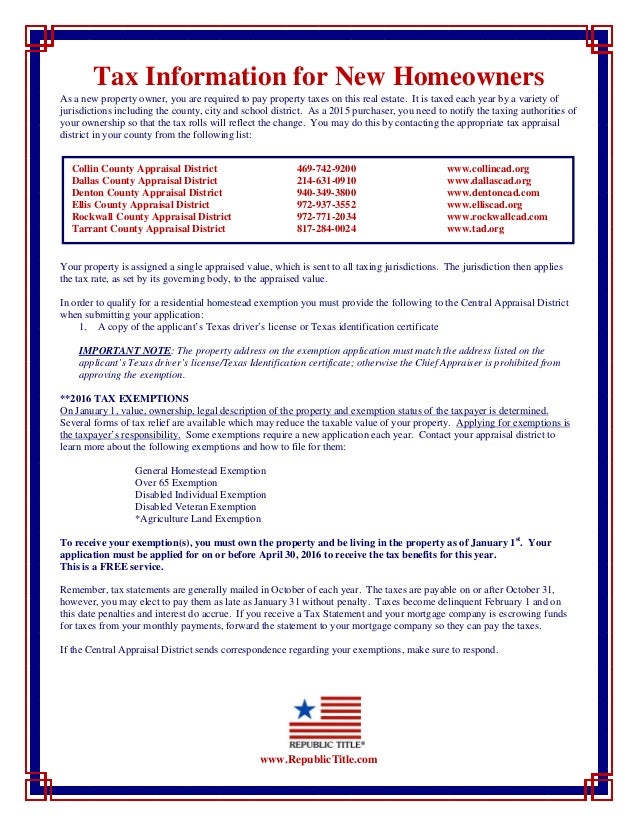

Source: communityimpact.com

Source: communityimpact.com

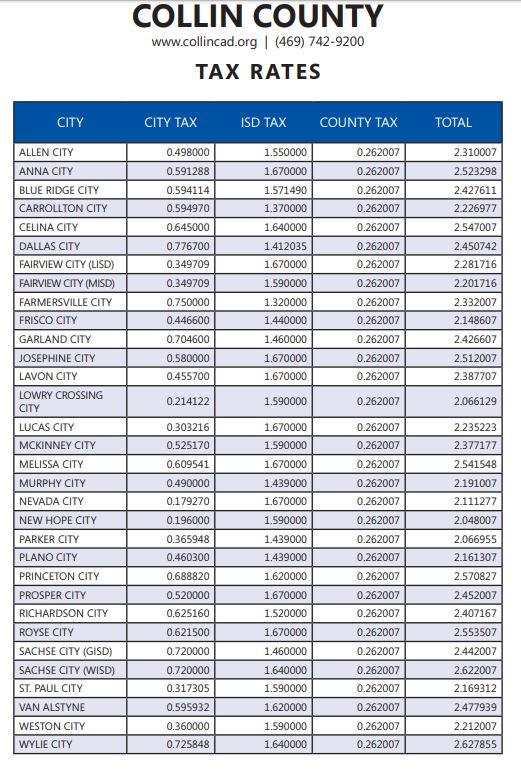

Collin County Tax Assessor-Collector McKinney Office Collin County Administration Building 2300 Bloomdale Rd Suite 2324 McKinney TX 75071 Map propertytaxcollincountytxgov 972-547-5020 Hours. For a faster search. Thats higher than Travis County and the states overall average of 183 but lower than counties like Tarrant Harris Bexar and Dallas. Collin County Tax Assessor-Collector McKinney Office Collin County Administration Building 2300 Bloomdale Rd Suite 2324 McKinney TX 75071 Map propertytaxcollincountytxgov 972-547-5020 Hours. Collin County Property Tax Rate.

Source: taxnetusa.com

Source: taxnetusa.com

In-depth Collin County TX Property Tax Information. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. User104622708004 tayterth Learn Commercial Real Estate realestatesource RJ Pepino therealrjpepino Tom Cruz tcruznc Thevaluer thevaluer. Discover short videos related to collin county property taxes on TikTok.

Any No HOA Fee 50month100month200month300. Collin County Property Tax Rate. Collin County Tax Assessor-Collector McKinney Office Collin County Administration Building 2300 Bloomdale Rd Suite 2324 McKinney TX 75071 Map propertytaxcollincountytxgov 972-547-5020 Hours. Collin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Collin County Texas. Tax amount varies by county.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Explore the latest videos from hashtags. User104622708004 tayterth Learn Commercial Real Estate realestatesource RJ Pepino therealrjpepino Tom Cruz tcruznc Thevaluer thevaluer. But the regions roots have a rich storied past with pioneer hardships and even a little Old West gunplay that hasnt been completely buried with new development. Collin County collects on average 219 of a propertys assessed fair market value as property tax. 181 of home value.

Source: communityimpact.com

Source: communityimpact.com

Collin County Property Tax Rate. User104622708004 tayterth Learn Commercial Real Estate realestatesource RJ Pepino therealrjpepino Tom Cruz tcruznc Thevaluer thevaluer. Estimates assume average property tax rate of 22 and the state average reduction of 52 due to data inconsistencies in underlying county data. The median property tax also known as real estate tax in Collin County is 435100 per year based on a median home value of 19900000 and a median effective property tax rate of 219 of property value. If you do not know the account number try Example.

Source: dfwurbanrealty.com

Source: dfwurbanrealty.com

Collin County Homes For Sale Collin Countys transformation from rural farmland to bustling urban hotspot may seem like a whirlwind affair when you look at the last 20 years. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. As mentioned Collin County property tax rates are the 15th highest in Texas with an average effective rate of 192. Collin County Tax Assessor-Collector McKinney Office Collin County Administration Building 2300 Bloomdale Rd Suite 2324 McKinney TX 75071 Map propertytaxcollincountytxgov 972-547-5020 Hours.

Source: youtube.com

Source: youtube.com

Collin County Property Taxes become delinquent on February 1. Explore the latest videos from hashtags. Collin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Collin County Texas. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. In Collier County Florida Ad Valorem or real taxes on real things according to their worth includes taxes on REAL ESTATE and taxes on a businesss Tangible Personal Property.

Source: texasscorecard.com

Source: texasscorecard.com

Estimates assume average property tax rate of 22 and the state average reduction of 52 due to data inconsistencies in underlying county data. Tax Calculator Use this feature to estimate the property taxes that would be owed annually on a property located within Collin County. Collin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Collin County Texas. But the regions roots have a rich storied past with pioneer hardships and even a little Old West gunplay that hasnt been completely buried with new development. If you do not know the account number try Example.

Source: texasscorecard.com

Source: texasscorecard.com

Account Number Account numbers can be found on your Tax Statement. - 5 pm 8 a. Any No HOA Fee 50month100month200month300. 181 of home value. In Collier County Florida Ad Valorem or real taxes on real things according to their worth includes taxes on REAL ESTATE and taxes on a businesss Tangible Personal Property.

Estimates assume average property tax rate of 22 and the state average reduction of 52 due to data inconsistencies in underlying county data. Discover short videos related to collin county property taxes on TikTok. The median property tax also known as real estate tax in Collin County is 435100 per year based on a median home value of 19900000 and a median effective property tax rate of 219 of property value. As mentioned Collin County property tax rates are the 15th highest in Texas with an average effective rate of 192. Why choose Home Tax Shield.

Source: texasscorecard.com

Source: texasscorecard.com

Collin County Property Taxes become delinquent on February 1. Any No HOA Fee 50month100month200month300. These records can include Collin County property tax assessments and assessment challenges appraisals and income taxes. Collin County Property Records are real estate documents that contain information related to real property in Collin County Texas. For a faster search.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title collin county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.