Your Clark county washington real estate taxes images are ready in this website. Clark county washington real estate taxes are a topic that is being searched for and liked by netizens now. You can Get the Clark county washington real estate taxes files here. Find and Download all free photos and vectors.

If you’re looking for clark county washington real estate taxes pictures information linked to the clark county washington real estate taxes topic, you have pay a visit to the ideal blog. Our site always provides you with hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

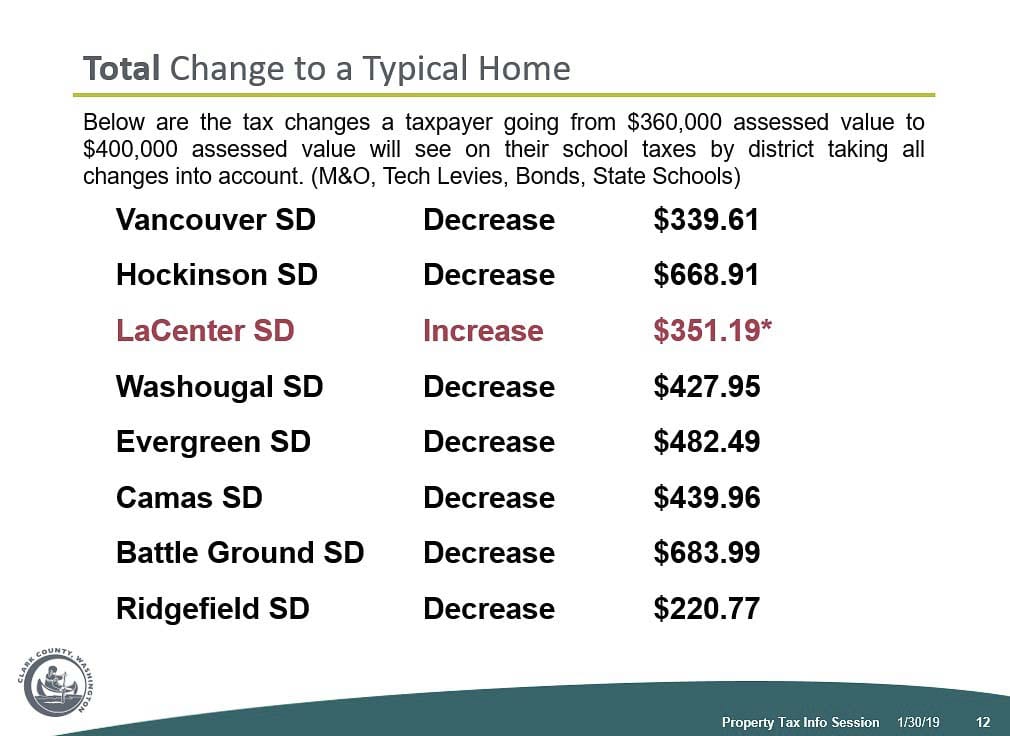

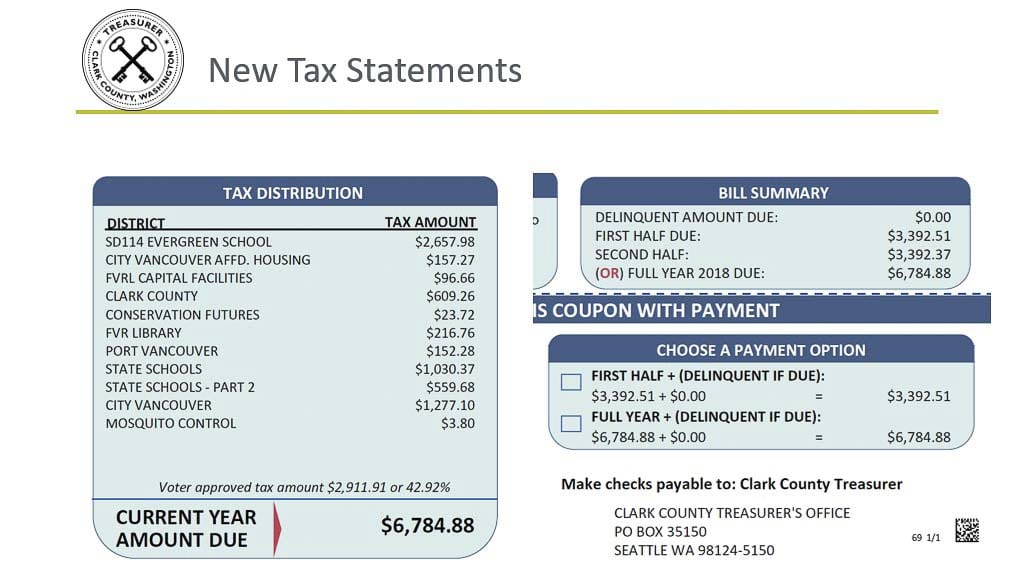

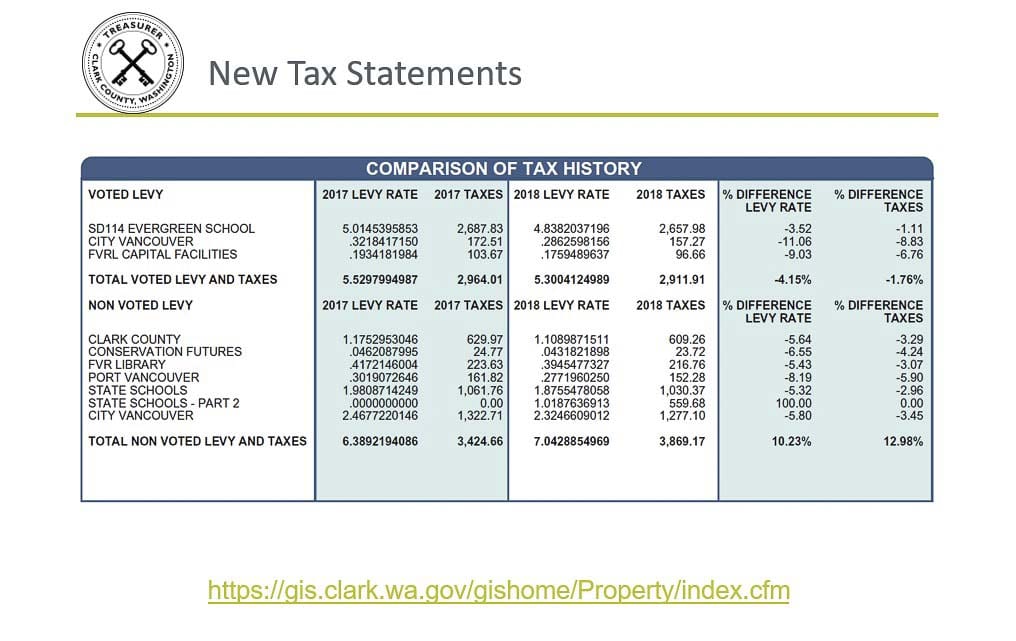

Clark County Washington Real Estate Taxes. Clark County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Clark County Washington. Clark County Treasurer PO Box 5000 Vancouver WA 98666. In Clark County property taxes are collected by the Treasurers Office and distributed to the various taxing districts that provide services to the property owner. Your county assessor and treasurer administer property tax.

Pin On Ez Real Estate Flyers From pinterest.com

Pin On Ez Real Estate Flyers From pinterest.com

REET also applies to transfers of controlling interest 50 or more in entities that own real property in the state. Market value has been defined by The Supreme Court as the sale price of real estate as agreed upon between a willing buyer and willing seller with neither being under duress to buy or sell. Clark County Property Records are real estate documents that contain information related to real property in Clark County Washington. These taxing districts include fire districts school districts port districts cities and the county. Find a Real Estate Record. Summary Real estate assessment information is available from Clarke Countys Online Mapping System which requires a physical address tax map number or owner name in order to search for parcels of interest.

REET also applies to transfers of controlling interest 50 or more in entities that own real property in the state.

The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date due until paid. County assessors value assess your property and county treasurers collect property tax. The document has moved here. The seller of the property typically pays the real estate excise tax although the buyer is liable for the tax if it is not paid. 1st Quarter - Due April 30. In Washington State all real and personal property is subject to tax unless specifically exempted by law eg.

Source: clark.wa.gov

Source: clark.wa.gov

Real Estate Excise Tax REET is the tax charged on the sale of real property. These taxing districts include fire districts school districts port districts cities and the county. Clark county property tax rate. Your county assessor and treasurer administer property tax. 1st Quarter - Due April 30.

Source: pinterest.com

Source: pinterest.com

2nd Quarter - Due July 31. Paying the tax Program changes effective Jan. Find a Real Estate Record. These taxing districts include fire districts school districts port districts cities and the county. Requests for an extension of payment on 2021 real property taxes under ESHB 1332 must be submitted to the county treasurer by April 30 2021.

Source: paydici.com

Source: paydici.com

Certain types of Tax Records are available to the general public while some Tax Records are only. 1st Quarter - Due April 30. Real Estate Excise Tax REET is the tax charged on the sale of real property. Mail your transaction to. These records can include Clark County property tax assessments and assessment challenges appraisals and income taxes.

Source: pinterest.com

Source: pinterest.com

The Clark County Department of Assessment establishes the true market value also known as market value for all taxable real properties within the county. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Please visit this page for more information. Find a Real Estate Record. They are a valuable tool for the real estate.

Requests for an extension of payment on 2021 real property taxes under ESHB 1332 must be submitted to the county treasurer by April 30 2021. Real Estate Excise Tax REET is the tax charged on the sale of real property. 1st Quarter - Due April 30. Clark county property tax rate. 1 2020 sales of real property are subject to a graduated real estate tax REET rate.

Source: pinterest.com

Source: pinterest.com

Every four years Clarke County hires an experienced appraisal firm which has. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month Open house Must have open house Parking spots Any1234 Must have garage Square Feet Any. The Clark County Department of Assessment establishes the true market value also known as market value for all taxable real properties within the county. Clark County Treasurer PO Box 5000 Vancouver WA 98666. Please visit this page for more information.

Source: clark.wa.gov

Source: clark.wa.gov

1 2020 sales of real property are subject to a graduated real estate tax REET rate. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The seller of the property typically pays the real estate excise tax although the buyer is liable for the tax if it is not paid. Unpaid tax can become a lien on the transferred property. The Department of Revenue does not collect property tax.

Source: realtor.com

Source: realtor.com

In Clark County property taxes are collected by the Treasurers Office and distributed to the various taxing districts that provide services to the property owner. Clark County Treasurer PO Box 5000 Vancouver WA 98666. The Clark County Department of Assessment establishes the true market value also known as market value for all taxable real properties within the county. The Clark County Treasurers Office serves as an agent of the State of Washington and all REET transactions are sent to and reviewed by the Washington Department of Revenue. Every four years Clarke County hires an experienced appraisal firm which has.

Source: clarkcountytoday.com

Source: clarkcountytoday.com

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Your county assessor and treasurer administer property tax. REET also applies to transfers of controlling interest 50 or more in entities that own real property in the state. The seller of the property typically pays the real estate excise tax although the buyer is liable for the tax if it is not paid.

Source:

Source:

Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month Open house Must have open house Parking spots Any1234 Must have garage Square Feet Any. In Washington State all real and personal property is subject to tax unless specifically exempted by law eg. Summary Real estate assessment information is available from Clarke Countys Online Mapping System which requires a physical address tax map number or owner name in order to search for parcels of interest. These taxing districts include fire districts school districts port districts cities and the county. The Clark County Department of Assessment establishes the true market value also known as market value for all taxable real properties within the county.

Source: pinterest.com

Source: pinterest.com

Market value has been defined by The Supreme Court as the sale price of real estate as agreed upon between a willing buyer and willing seller with neither being under duress to buy or sell. Your county assessor and treasurer administer property tax. REET also applies to transfers of controlling interest 50 or more in entities that own real property in the state. They are maintained by various government offices in Clark County Washington State and at the Federal level. All the following special assessments assessments are included on your global tax statement and have the same due dates as Real Property tax.

Source: clark.wa.gov

Source: clark.wa.gov

Mail your transaction to. Unpaid tax can become a lien on the transferred property. Property owners have two years from the date of the certificate to redeem the property by paying the property taxes and all associated costs in full. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Clark county property tax rate.

Source: clarkcountytoday.com

Source: clarkcountytoday.com

They are a valuable tool for the real estate. Clark county property tax rate. Property owners have two years from the date of the certificate to redeem the property by paying the property taxes and all associated costs in full. Summary Real estate assessment information is available from Clarke Countys Online Mapping System which requires a physical address tax map number or owner name in order to search for parcels of interest. Household goods and personal effectsIn Clark County property taxes are collected by the Treasurers Office and distributed to the various taxing districts that provide services to the property.

Find a Real Estate Record. The Department of Revenue does not collect property tax. The Clark County Treasurer provides an online payment portal for you to pay your property taxes. Clark County Property Records are real estate documents that contain information related to real property in Clark County Washington. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month Open house Must have open house Parking spots Any1234 Must have garage Square Feet Any.

Source:

Source:

These taxing districts include fire districts school districts port districts cities and the county. Property Taxes Clark County. Clark County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Clark County Washington. Property owners have two years from the date of the certificate to redeem the property by paying the property taxes and all associated costs in full. Clark County Property Records are real estate documents that contain information related to real property in Clark County Washington.

Source: pinterest.com

Source: pinterest.com

The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date due until paid. Market value has been defined by The Supreme Court as the sale price of real estate as agreed upon between a willing buyer and willing seller with neither being under duress to buy or sell. Paying the tax Program changes effective Jan. The Clark County Treasurers Office serves as an agent of the State of Washington and all REET transactions are sent to and reviewed by the Washington Department of Revenue. Additionally the Treasurer is responsible for overseeing the receipt and disbursement of County revenues and for administrating banking and investments services.

Source: clarkcountytoday.com

Source: clarkcountytoday.com

Every four years Clarke County hires an experienced appraisal firm which has. The document has moved here. Property owners have two years from the date of the certificate to redeem the property by paying the property taxes and all associated costs in full. 2nd Quarter - Due July 31. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: realtor.com

Source: realtor.com

Please visit this page for more information. Household goods and personal effects. Clark County Property Records are real estate documents that contain information related to real property in Clark County Washington. The Department of Revenue does not collect property tax. Property Taxes Clark County.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title clark county washington real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.