Your City of boston real estate tax assessments images are available. City of boston real estate tax assessments are a topic that is being searched for and liked by netizens today. You can Get the City of boston real estate tax assessments files here. Get all free images.

If you’re looking for city of boston real estate tax assessments images information linked to the city of boston real estate tax assessments keyword, you have come to the right site. Our site frequently gives you hints for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

City Of Boston Real Estate Tax Assessments. The information assists homeowners directly in their ownership responsibilities by providing the current value and tax status of their property. Taxpayer Referral Assistance Center. Gives property or parcel ownership together with value information which ensures fair assessment of Boston taxable and non-taxable property of all types and classifications. Please check them before you apply.

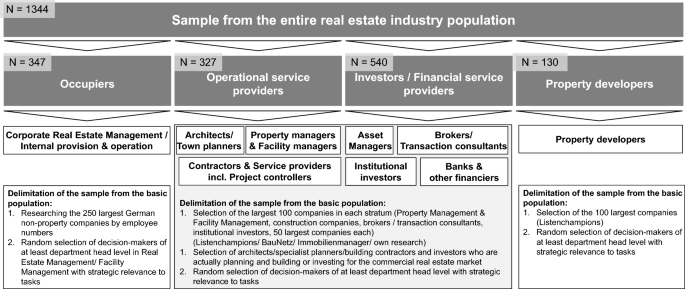

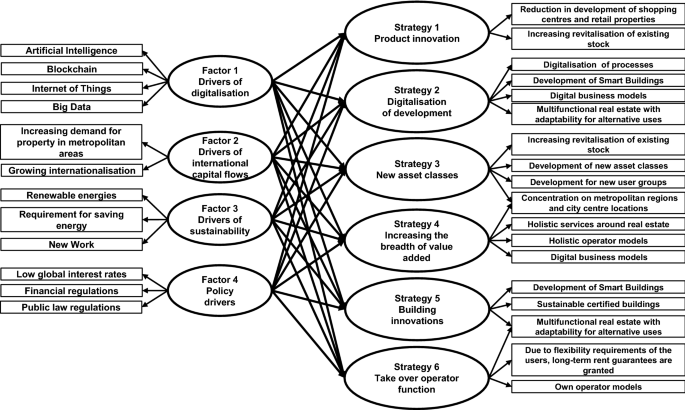

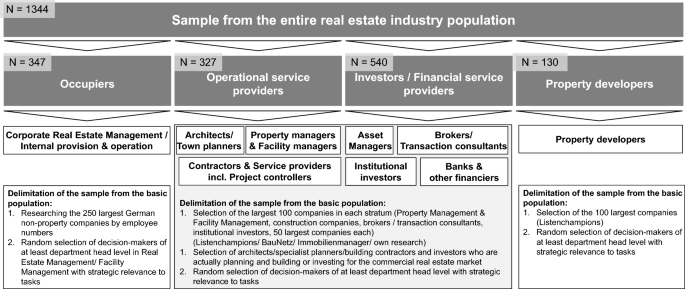

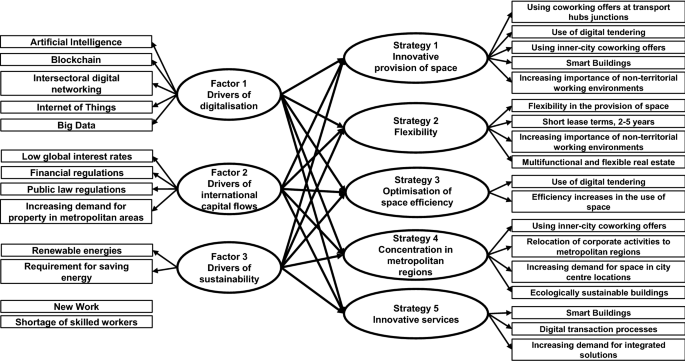

Transformation Of The Real Estate And Construction Industry Empirical Findings From Germany Springerlink From link.springer.com

Transformation Of The Real Estate And Construction Industry Empirical Findings From Germany Springerlink From link.springer.com

City Of Boston Real Estate Values. The information assists homeowners directly in their ownership responsibilities by providing the current value and tax status of their property. We created a page to give you more information about these programs. City Hall Hours Directions. The same section provided for the election by the City Council Mayor and Alderman or by the citizens of Assessors and Assistant Assessors. You have three options when submitting an application.

Please check them before you apply.

Give businesses tax relief by providing a phased-in assessment of the total value of the property from 5 to 20 years. City Of Boston Real Estate Values. Select a Department Administration and Finance Animal Control Archives and Records Arts Tourism Special Events Assessing Auditing Bikes Board of Appeals Boston. City Hall Hours Directions. Before you get started by mail To file an abatement you need to meet these requirements. This allows us to charge different rates for residential and commercial property.

Source: pinterest.com

Source: pinterest.com

Select a Department Administration and Finance Animal Control Archives and Records Arts Tourism Special Events Assessing Auditing Bikes Board of Appeals Boston. Section 15 of Chapter 110 of the Acts of 1821 An Act Establishing the City of Boston provided the City Council with the power to assess taxes. City Hall Hours Directions. Scope and Contents note Records of taxes assessed for real estate personal estate and poll taxes. Boston Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Boston Massachusetts.

Source: mckinsey.com

Source: mckinsey.com

Taxpayer Referral Assistance Center. Search FY2021 Real Estate Assessments and Taxes. You can only submit an application after your third-quarter tax bill and no. Select a Department Administration and Finance Animal Control Archives and Records Arts Tourism Special Events Assessing Auditing Bikes Board of Appeals Boston. Please check them before you apply.

Source: link.springer.com

Source: link.springer.com

The City has tax incentive programs to advance its economic development and housing goals. City Hall Hours Directions. Taxpayer Referral Assistance Center. You have three options when submitting an application. Select a Department Administration and Finance Animal Control Archives and Records Arts Tourism Special Events Assessing Auditing Bikes Board of Appeals Boston.

Source: pinterest.com

Source: pinterest.com

Boston Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Boston Massachusetts. By mail By mail In person In person Close. The City of Boston operates under a property tax classification system. 1 City Hall Sq 0504203000 352R Blue Hill Ave Apt 3. The information assists homeowners directly in their ownership responsibilities by providing the current value and tax status of their property.

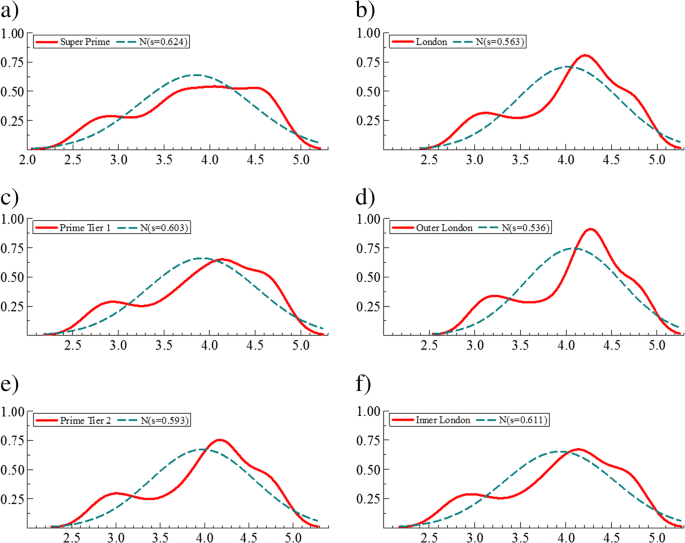

Source: researchgate.net

Source: researchgate.net

We created a page to give you more information about these programs. Scope and Contents note Records of taxes assessed for real estate personal estate and poll taxes. Boston Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Boston Massachusetts. Facts and Figures - Fiscal Year 2002 presents in text charts and tables an overview of property taxes in the City of Boston. By mail By mail In person In person Close.

Source: allianz-realestate.com

Source: allianz-realestate.com

City Hall Hours Directions. By mail By mail In person In person Close. The City has tax incentive programs to advance its economic development and housing goals. All Time 42 New Post Past 24 Hours Past Week Past month. These programs include Chapter 121A Chapter 121B Tax Increment Financing and Special Tax Assessment.

Source: link.springer.com

Source: link.springer.com

The City of Boston Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in City of Boston. Before you get started by mail To file an abatement you need to meet these requirements. To preserve their integrity the identifiers PID CM_ID GIS_ID ZIPCODE and MAIL_ZIPCODE all are marked with an underscore _ as the last character. Boston Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Boston Massachusetts. Real Estate Taxes Tax Bills and Payments.

Source: pinterest.com

Source: pinterest.com

City Hall Hours Directions. To preserve their integrity the identifiers PID CM_ID GIS_ID ZIPCODE and MAIL_ZIPCODE all are marked with an underscore _ as the last character. Select a Department Administration and Finance Animal Control Archives and Records Arts Tourism Special Events Assessing Auditing Bikes Board of Appeals Boston. Our work in the Collecting Division involves collecting property taxes and all other monies due to the City while serving taxpayers in a professional courteous manner. This allows us to charge different rates for residential and commercial property.

Source: link.springer.com

Source: link.springer.com

The City of Boston Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in City of Boston. We mail all tax bills and collect both current and delinquent taxes. You can see individual TIF and STA agreements at the bottom of this page. Includes real estate valuations 1822-1973. You can only submit an application after your third-quarter tax bill and no.

Source: lincolninst.edu

Source: lincolninst.edu

Through comparative and historical data a taxpayer can compare. Scope and Contents note Records of taxes assessed for real estate personal estate and poll taxes. The City of Boston operates under a property tax classification system. The assessment of poll taxes was abolished in 1963. The City of Boston Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in City of Boston.

Source: pinterest.com

Source: pinterest.com

This allows us to charge different rates for residential and commercial property. Want to learn more. The City of Boston Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. The deadline for filing a FY2021 Real Estate Property Tax Abatement Application was Tuesday February 2 2021. City Of Boston Real Estate Values.

Source: pinterest.com

Source: pinterest.com

These programs include Chapter 121A Chapter 121B Tax Increment Financing and Special Tax Assessment. The Fiscal Year 2002 assessments represent the full and fair cash value of property as of January 1 2001. Before you get started by mail To file an abatement you need to meet these requirements. Select a Department Administration and Finance Animal Control Archives and Records Arts Tourism Special Events Assessing Auditing Bikes Board of Appeals Boston. So if you own the property you need to make sure that the property taxes are paid.

Source: pinterest.com

Source: pinterest.com

Facts and Figures - Fiscal Year 2002 presents in text charts and tables an overview of property taxes in the City of Boston. Select a Department Administration and Finance Animal Control Archives and Records Arts Tourism Special Events Assessing Auditing Bikes Board of Appeals Boston. Taxpayer Referral Assistance Center. You can see individual TIF and STA agreements at the bottom of this page. An abatement is a reduction in your property taxes.

Source: link.springer.com

Source: link.springer.com

You can only submit an application after your third-quarter tax bill and no. Before you get started by mail To file an abatement you need to meet these requirements. The information assists homeowners directly in their ownership responsibilities by providing the current value and tax status of their property. We prepare and file tax takings and tax certification liens issue municipal lien certificates and prepare petitions for foreclosures with the Law Department. Taxpayer Referral Assistance Center.

Select a Department Administration and Finance Animal Control Archives and Records Arts Tourism Special Events Assessing Auditing Bikes Board of Appeals Boston. By mail By mail In person In person Close. These programs include Chapter 121A Chapter 121B Tax Increment Financing and Special Tax Assessment. The City of Boston operates under a property tax classification system. Tax Records include property tax assessments property appraisals and income tax records.

Source: allianz-realestate.com

Source: allianz-realestate.com

City Hall Hours Directions. TIF and STA plans must be approved by a City Council vote. To preserve their integrity the identifiers PID CM_ID GIS_ID ZIPCODE and MAIL_ZIPCODE all are marked with an underscore _ as the last character. Real Estate Taxes Tax Bills and Payments. Give businesses tax relief by providing a phased-in assessment of the total value of the property from 5 to 20 years.

Source: researchgate.net

Source: researchgate.net

By mail By mail In person In person Close. Give businesses tax relief by providing a phased-in assessment of the total value of the property from 5 to 20 years. Tax Agreements by Program. The tax rate is the amount a taxpayer owes for each one thousand dollars of property value in a given year. The information assists homeowners directly in their ownership responsibilities by providing the current value and tax status of their property.

Source: allianz-realestate.com

Source: allianz-realestate.com

How to Obtain an Online Application for Abatement andor Exemption. To preserve their integrity the identifiers PID CM_ID GIS_ID ZIPCODE and MAIL_ZIPCODE all are marked with an underscore _ as the last character. Assessed taxes on real estate stay with the property not the name on the tax bill. Want to learn more. The City of Boston Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title city of boston real estate tax assessments by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.