Your Chicago real estate transfer tax calculator images are available in this site. Chicago real estate transfer tax calculator are a topic that is being searched for and liked by netizens now. You can Download the Chicago real estate transfer tax calculator files here. Download all free vectors.

If you’re searching for chicago real estate transfer tax calculator images information related to the chicago real estate transfer tax calculator keyword, you have visit the ideal blog. Our site frequently provides you with hints for viewing the highest quality video and image content, please kindly search and locate more informative video articles and images that match your interests.

Chicago Real Estate Transfer Tax Calculator. Apply Senior Citizen Blind or Disabled Low Income Housing. TheState of Illinois the County and the local municipality ie. The county tax is calculated in the same method but at a rate of 55 cents per 500. City of Chicago.

Transfer Taxes From realpropertyalliance.org

Transfer Taxes From realpropertyalliance.org

TOTAL Per 1000 Property Value. CITY TAX Per 1000. The state of Illinois has a transfer tax that is typically paid by sellers at a rate of. TheState of Illinois the County and the local municipality ie. The City of Chicago. The tax shall be at the rate of 375 per 50000 of the transfer price or fraction thereof of the real property or the beneficial interest in real property.

Documentary Transfer TaxFees Pursuant to Rev Tax Code Sec.

Effective 112016 in accordance with URPO Ruling 5 all Real Property Transfer Tax declarations must be filed online at httpsmytaxillinoisgovMyDec. The Realty Transfer Fee RTF was established in New Jersey in 1968 to offset the costs of tracking real estate transactions. 4 Act 134 of 1966 - County. CITY TAX Per 1000. Benefits of online filing are. Payment of the RTF is a prerequisite for recording the deed and it should be noted that in addition to the transfer fee paid by the sellers a 1 fee.

Source: pinterest.com

Source: pinterest.com

TheState of Illinois the County and the local municipality ie. Typically buyers pay 7501000 and sellers pay 3001000 For more information on the citys real property transfer taxes there is some useful information available here. The information contained in this website is provided as a courtesy and is not to be construed as legal advice or a legal opinion with respect to a particular real estate. 11911-11913 subject to change - Disclaimer. Transfer Tax Calculator Chicago Real Estate Lawyers Law.

Source: ar.pinterest.com

Source: ar.pinterest.com

Download Printable Real Estate Tax Rate Charts. Originally called the Property Purchase Tax the PPT was first introduced in 1987 as a wealth tax to discourage speculation and cost 1 of the first 200000 and 2 of the remainder although 95 of home purchases did not qualify for the tax at the time as they were below the 200000 mark. TheState of Illinois the County and the local municipality ie. COUNTY TAX Per 1000. The City of Chicago.

Source: blog.rentconfident.com

Source: blog.rentconfident.com

The information contained in this website is provided as a courtesy and is not to be construed as legal advice or a legal opinion with respect to a particular real estate. The tax shall be at the rate of 375 per 50000 of the transfer price or fraction thereof of the real property or the beneficial interest in real property. Intangibles Tax Calculator. TOTAL Per 1000 Property Value. 11911-11913 subject to change - Disclaimer.

Source: chicagoclosings.com

Source: chicagoclosings.com

By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes which may be charged. City of Chicago Transfer Tax Calculator Both the buyer and seller are required to pay a portion of the City of Chicago Transfer Tax. Intangibles Tax Calculator. Benefits of online filing are. Transfer tax rates are frequently charged per each monetary unit of sale price.

Source: pinterest.com

Source: pinterest.com

Your declaration will advance through the approval stages of the recording process. Houses 3 days ago In a typical real estate transaction a transfer tax is chargedby threegovernment bodies. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes which may be charged. New Jersey Transfer Tax Rate Calculator. 11911-11913 subject to change - Disclaimer.

Source: pinterest.com

Source: pinterest.com

Houses 3 days ago In a typical real estate transaction a transfer tax is chargedby threegovernment bodies. Apply Senior Citizen Blind or Disabled Low Income Housing. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes which may be charged. TheState of Illinois the County and the local municipality ie. TheState of Illinois the County and the local municipality ie.

Source: illinoislawreview.org

Source: illinoislawreview.org

The Realty Transfer Fee RTF was established in New Jersey in 1968 to offset the costs of tracking real estate transactions. The tax rate is 375 per 500 of the transfer price or fraction thereof of the real property or the beneficial interest in real property. Apply Senior Citizen Blind or Disabled Low Income Housing. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes which may be charged. Originally called the Property Purchase Tax the PPT was first introduced in 1987 as a wealth tax to discourage speculation and cost 1 of the first 200000 and 2 of the remainder although 95 of home purchases did not qualify for the tax at the time as they were below the 200000 mark.

Source: ar.pinterest.com

Source: ar.pinterest.com

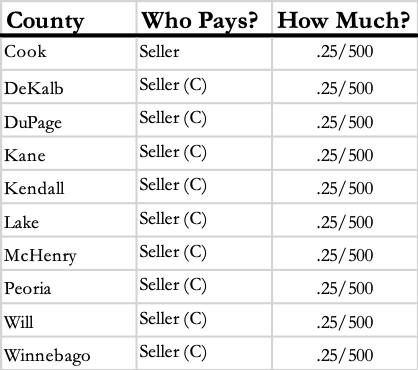

TheState of Illinois the County and the local municipality ie. 11911-11913 subject to change - Disclaimer. The tax rate is 375 per 500 of the transfer price or fraction thereof of the real property or the beneficial interest in real property. TRANSFER TAXES - CHICAGO METROPOLITAN AREA As of Oct 9 2017 Taxing District Primary Liability Amount of Tax Address Telephone Comments Link to Website NOTE. While every effort has been made to ensure the accuracy of this chart the information contained herein is subject to change at any time.

Source: illinoislawreview.org

Source: illinoislawreview.org

Finding the Right Real Estate Attorneys. 11911-11913 subject to change - Disclaimer. Transfer Tax Calculator Chicago Real Estate Lawyers Law. Documentary Transfer Tax Fees Pursuant to Rev Tax Code Sec. COUNTY TAX Per 1000.

Source: civicfed.org

Source: civicfed.org

Apply Senior Citizen Blind or Disabled Low Income Housing. The Realty Transfer Fee RTF was established in New Jersey in 1968 to offset the costs of tracking real estate transactions. Transfer Tax Calculator Chicago Real Estate Lawyers Law. Documentary Transfer TaxFees Pursuant to Rev Tax Code Sec. CITY TAX Per 1000.

Source: pinterest.com

Source: pinterest.com

Transfer Tax Calculator Chicago Real Estate Lawyers Law. History of the Property Transfer Tax. 11911-11913 subject to change - Disclaimer. The Realty Transfer Fee RTF was established in New Jersey in 1968 to offset the costs of tracking real estate transactions. 4 Act 134 of 1966 - County.

Source: ryanhardychicago.com

Source: ryanhardychicago.com

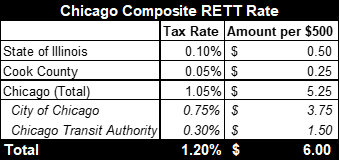

Transfer Tax Calculator Chicago Real Estate Lawyers Law. The Realty Transfer Fee RTF was established in New Jersey in 1968 to offset the costs of tracking real estate transactions. Real Estate Transfer Tax in Chicago The current composite rate for a real estate transfer in Chicago is 12 or 6 per every 500 of the property value. Chicago Transfer Tax Calculator. TOTAL Per 1000 Property Value.

Source: in.pinterest.com

Source: in.pinterest.com

While every effort has been made to ensure the accuracy of this chart the information contained herein is subject to change at any time. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes. The county tax is calculated in the same method but at a rate of 55 cents per 500. Apply Senior Citizen Blind or Disabled Low Income Housing. The tax rate is 375 per 500 of the transfer price or fraction thereof of the real property or the beneficial interest in real property.

Source: realpropertyalliance.org

Source: realpropertyalliance.org

History of the Property Transfer Tax. Transfer Tax Calculator In a typical real estate transaction a transfer tax is chargedby threegovernment bodies. New Jersey Transfer Tax Rate Calculator. The City of Chicago. The City of Chicago.

Source: anmtg.com

Source: anmtg.com

Chicago Illinois Code of Ordinances Sec. Apply Senior Citizen Blind or Disabled Low Income Housing. TOTAL Per 1000 Property Value. Seller Transfer Tax Calculator for State of Georgia. CITY TAX Per 1000.

Source: pinterest.com

Source: pinterest.com

11911-11913 subject to change - Disclaimer. Typically buyers pay 7501000 and sellers pay 3001000 For more information on the citys real property transfer taxes there is some useful information available here. Your declaration will advance through the approval stages of the recording process. TOTAL Per 1000 Property Value. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza Atlanta GA 30326 ATLANTA TITLE.

Source: pinterest.com

Source: pinterest.com

4 Act 134 of 1966 - County. 11911-11913 subject to change - Disclaimer. The state of Illinois has a transfer tax that is typically paid by sellers at a rate of. Apply Senior Citizen Blind or Disabled Low Income Housing. Seller Transfer Tax Calculator for State of Georgia.

Source: ryanhardychicago.com

Source: ryanhardychicago.com

Chicago Transfer Tax Calculator. 4 Act 134 of 1966 - County. City of Chicago Transfer Tax Calculator Both the buyer and seller are required to pay a portion of the City of Chicago Transfer Tax. Houses 1 days ago Transfer Tax Calculator In a typical real estate transaction a transfer tax is chargedby threegovernment bodies. Seller Transfer Tax Calculator for State of Georgia.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title chicago real estate transfer tax calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.