Your Chesterfield county va real estate tax assessment images are ready in this website. Chesterfield county va real estate tax assessment are a topic that is being searched for and liked by netizens now. You can Download the Chesterfield county va real estate tax assessment files here. Get all royalty-free photos and vectors.

If you’re looking for chesterfield county va real estate tax assessment images information related to the chesterfield county va real estate tax assessment keyword, you have come to the right blog. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

Chesterfield County Va Real Estate Tax Assessment. Chesterfield County collects on average 083 of a propertys assessed fair market value as property tax. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Chesterfield County Tax Appraisers office. They are a valuable tool for the real estate. The value is defined as the sale price of real estate as agreed upon between a willing buyer and willing seller with neither being under any duress to either buy or sell.

While the Office of the Real Estate Assessor has attempted to ensure that the assessment. Elderly and Disabled Tax Relief Form and Instructions PDF Veterans The VA General Assembly exempted from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. 2021 Local Tax Rates in Chesterfield County Real Estate Tax Machinery Tools Tax Personal Property Tax. 8 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. The only exception to this is for boats which must be registered with the Virginia Department of Wildlife Resources DWR or the US. Official records are located in the Office of the Real Estate Assessor.

The median property tax in Chesterfield County Virginia is 1964 per year for a home worth the median value of 235600.

Assessors appraise values of all land and commercial property real property and business fixed asset personal property. Chesterfield County Property Records are real estate documents that contain information related to real property in Chesterfield County Virginia. They are maintained by various government offices in Chesterfield County Virginia State and at the Federal level. The value is defined as the sale price of real estate as agreed upon between a willing buyer and willing seller with neither being under any duress to either buy or sell. The median property tax in Chesterfield County Virginia is 1964 per year for a home worth the median value of 235600. All property must first be registered with the Virginia Department of Motor Vehicles DMV.

Vehicle or Business For questions about the following please visit the Office of the Commissioner of the Revenue webpage or call 804-748-1281. For comparison the median home value in Chesterfield County is 23560000. Elderly and Disabled Tax Relief Form and Instructions PDF Veterans The VA General Assembly exempted from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. Assessors appraise values of all land and commercial property real property and business fixed asset personal property. Chesterfield County collects on average 083 of a propertys assessed fair market value as property tax.

Source: realtor.com

Source: realtor.com

Chesterfield County levies a tax each calendar year on personal property with situs in the county. Elderly and Disabled Tax Relief Form and Instructions PDF Veterans The VA General Assembly exempted from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. The value is defined as the sale price of real estate as agreed upon between a willing buyer and willing seller with neither being under any duress to either buy or sell. All property must first be registered with the Virginia Department of Motor Vehicles DMV. While the Office of the Real Estate Assessor has attempted to ensure that the assessment.

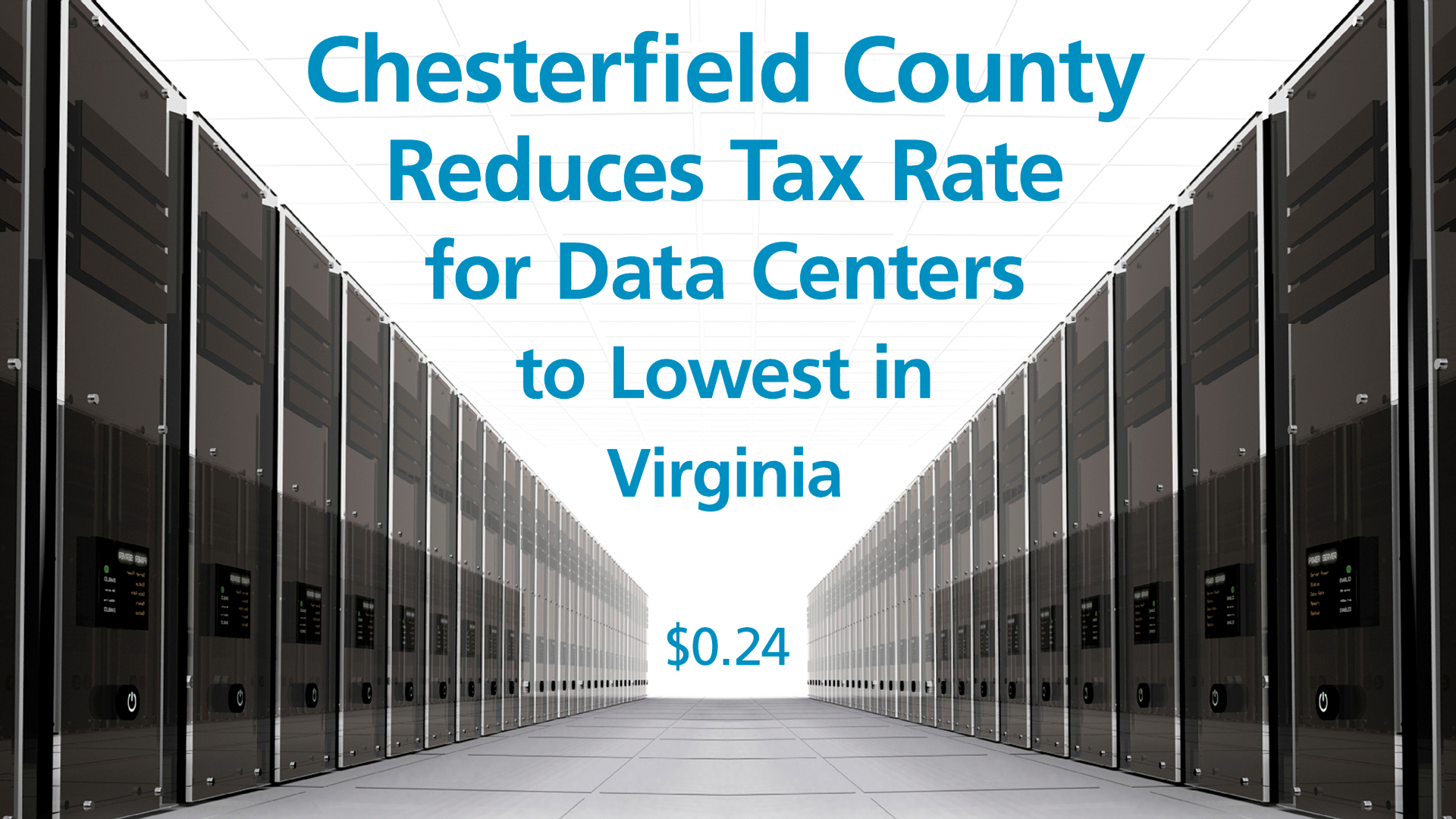

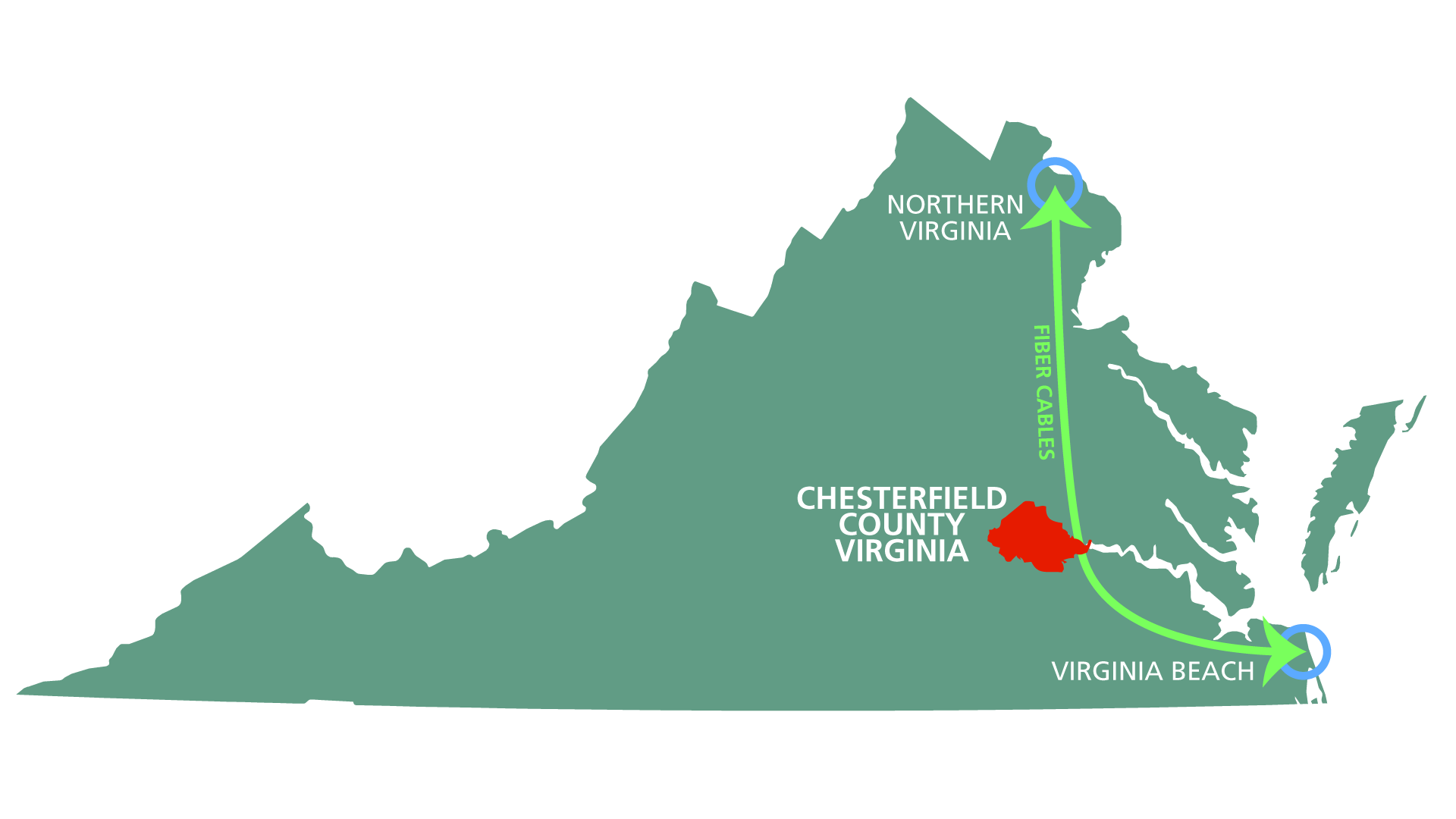

Source: chesterfieldbusiness.com

Source: chesterfieldbusiness.com

Chesterfield County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. The only exception to this is for boats which must be registered with the Virginia Department of Wildlife Resources DWR or the US. Official records are located in the Office of the Real Estate Assessor. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Chesterfield County Tax Appraisers office. The office determines property tax values tax rates maintains and updates the local tax assessment rolls.

Source: smartasset.com

Source: smartasset.com

Chesterfield County levies a tax each calendar year on personal property with situs in the county. While the Office of the Real Estate Assessor has attempted to ensure that the assessment. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. Please note that these assessment records are not the official assessment records of Chesterfield County. Map Parcel Number Real Estate Property Address Real Estate Certified Secure Support We are a PCI Certified Level 1 service provider Chesterfield County VA.

The Department of Real Estate Assessments operates in accordance with the Code of Virginia Title 581 Taxation and the Charter and Code of. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. Map Parcel Number Real Estate Property Address Real Estate Certified Secure Support We are a PCI Certified Level 1 service provider Chesterfield County VA. Chesterfield County levies a tax each calendar year on personal property with situs in the county. Under Virginia State Law these real estate assessment records are public information.

Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. These records can include Chesterfield County property tax assessments and assessment challenges appraisals and income taxes. The value is defined as the sale price of real estate as agreed upon between a willing buyer and willing seller with neither being under any duress to either buy or sell. They are maintained by various government offices in Chesterfield County Virginia State and at the Federal level. The office determines property tax values tax rates maintains and updates the local tax assessment rolls.

Source: chesterfieldbusinessnews.com

Source: chesterfieldbusinessnews.com

They are maintained by various government offices in Chesterfield County Virginia State and at the Federal level. Map Parcel Number Real Estate Property Address Real Estate Certified Secure Support We are a PCI Certified Level 1 service provider Chesterfield County VA. Chesterfield County collects on average 083 of a propertys assessed fair market value as property tax. While the Office of the Real Estate Assessor has attempted to ensure that the assessment. The only exception to this is for boats which must be registered with the Virginia Department of Wildlife Resources DWR or the US.

Source: billpayit.com

Source: billpayit.com

Please note that these assessment records are not the official assessment records of Chesterfield County. Chesterfield County Va Real Estate Tax Rate 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. Official records are located in the Office of the Real Estate Assessor. Chesterfield County Property Records are real estate documents that contain information related to real property in Chesterfield County Virginia. Chesterfield County collects on average 083 of a propertys assessed fair market value as property tax.

Source: loc.gov

Source: loc.gov

Elderly and Disabled Tax Relief Form and Instructions PDF Veterans The VA General Assembly exempted from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. All property must first be registered with the Virginia Department of Motor Vehicles DMV. The median property tax in Chesterfield County Virginia is 1964 per year for a home worth the median value of 235600. While the Office of the Real Estate Assessor has attempted to ensure that the assessment. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended.

Source: chesterfieldbusinessnews.com

Source: chesterfieldbusinessnews.com

Chesterfield County Va Real Estate Tax Rate 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. The office determines property tax values tax rates maintains and updates the local tax assessment rolls. Department of Veterans Affairs to have a 100 percent service-connected and permanent and total disability and who occupies the real property as his or her. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. For comparison the median home value in Chesterfield County is 23560000.

Source: realtor.com

Source: realtor.com

Map Parcel Number Real Estate Property Address Real Estate Certified Secure Support We are a PCI Certified Level 1 service provider Chesterfield County VA. Chesterfield County collects on average 083 of a propertys assessed fair market value as property tax. Department of Veterans Affairs to have a 100 percent service-connected and permanent and total disability and who occupies the real property as his or her. For comparison the median home value in Chesterfield County is 23560000. While the Office of the Real Estate Assessor has attempted to ensure that the assessment.

Official records are located in the Office of the Real Estate Assessor. Assessors appraise values of all land and commercial property real property and business fixed asset personal property. Vehicle or Business For questions about the following please visit the Office of the Commissioner of the Revenue webpage or call 804-748-1281. 2021 Local Tax Rates in Chesterfield County Real Estate Tax Machinery Tools Tax Personal Property Tax. The Department of Real Estate Assessments operates in accordance with the Code of Virginia Title 581 Taxation and the Charter and Code of.

While the Office of the Real Estate Assessor has attempted to ensure that the assessment. 2021 Local Tax Rates in Chesterfield County Real Estate Tax Machinery Tools Tax Personal Property Tax. All property must first be registered with the Virginia Department of Motor Vehicles DMV. Under Virginia State Law these real estate assessment records are public information. For comparison the median home value in Chesterfield County is 23560000.

Please note that these assessment records are not the official assessment records of Chesterfield County. 12 Zeilen Filing Renewals for Real Estate Tax Exemption First Time Filer May Apply Any Time. Official records are located in the Office of the Real Estate Assessor. Chesterfield County levies a tax each calendar year on personal property with situs in the county. While the Office of the Real Estate Assessor has attempted to ensure that the assessment.

Source: realtor.com

Source: realtor.com

Assessors appraise values of all land and commercial property real property and business fixed asset personal property. These records can include Chesterfield County property tax assessments and assessment challenges appraisals and income taxes. They are a valuable tool for the real estate. Official records are located in the Office of the Real Estate Assessor. Official records are located in the Office of the Real Estate Assessor.

The only exception to this is for boats which must be registered with the Virginia Department of Wildlife Resources DWR or the US. 8 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. Official records are located in the Office of the Real Estate Assessor. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. Department of Veterans Affairs to have a 100 percent service-connected and permanent and total disability and who occupies the real property as his or her.

Chesterfield County Property Records are real estate documents that contain information related to real property in Chesterfield County Virginia. 2021 Local Tax Rates in Chesterfield County Real Estate Tax Machinery Tools Tax Personal Property Tax. Elderly and Disabled Tax Relief Form and Instructions PDF Veterans The VA General Assembly exempted from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. All property must first be registered with the Virginia Department of Motor Vehicles DMV. 12 Zeilen Filing Renewals for Real Estate Tax Exemption First Time Filer May Apply Any Time.

Source: chesterfield.gov

Source: chesterfield.gov

Chesterfield County levies a tax each calendar year on personal property with situs in the county. Chesterfield County Va Real Estate Tax Rate 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. They are a valuable tool for the real estate. Elderly and Disabled Tax Relief Form and Instructions PDF Veterans The VA General Assembly exempted from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. Under Virginia State Law these real estate assessment records are public information.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title chesterfield county va real estate tax assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.