Your Chesterfield county real estate taxes images are available. Chesterfield county real estate taxes are a topic that is being searched for and liked by netizens today. You can Find and Download the Chesterfield county real estate taxes files here. Download all royalty-free vectors.

If you’re looking for chesterfield county real estate taxes images information related to the chesterfield county real estate taxes interest, you have come to the ideal site. Our website always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

Chesterfield County Real Estate Taxes. These records can include Chesterfield County property tax assessments and. Pay Personal Property Real Estate Taxes Pay for your real estate and personal property taxes online. The County does not receive any portion of these fees. Chesterfield County Va Real Estate Tax Rate 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value.

7631 Centerbrook Ln Chesterfield Va 23832 Realtor Com From realtor.com

7631 Centerbrook Ln Chesterfield Va 23832 Realtor Com From realtor.com

Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. All property must first be registered with the Virginia Department of Motor Vehicles DMV. Any errors or omissions should be reported for investigation. Chesterfield County levies a tax each calendar year on personal property with situs in the county. Chesterfield County Va Real Estate Tax Rate 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. The Chesterfield County - SC Tax Office makes every effort to produce and publish the most accurate information possible.

The County does not receive any portion of these fees.

Chesterfield County levies a tax each calendar year on personal property with situs in the county. You may redeem your property by paying to the person officially charged with the collection of taxes assessments penalties and cost together with 3 6 9 or 12 interest for 1. Property taxes are determined at local levels being used for schools fire and police protection public parks and other benefits. Please note that these assessment records are not the official assessment records of Chesterfield County. Real estate taxes are calculated by multiplying the propertys assessed value by the current tax rate. The Chesterfield County - SC Tax Office makes every effort to produce and publish the most accurate information possible.

Source: realtor.com

Source: realtor.com

Property taxes are determined at local levels being used for schools fire and police protection public parks and other benefits. The Virginia Tax Code represents the main legal document regarding taxation. The median property tax in Chesterfield County Virginia is 1964 per year for a home worth the median value of 235600. Written documents deeds wills etc relating to the ownership of real estate filed in the Clerks Office of the Circuit Court of Chesterfield County are received and processed daily by the Assessors Office. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended.

Source: realtor.com

Source: realtor.com

These fees are charged by MSB our online payment processor and are not part of your tax. Real estate taxes are calculated by multiplying the propertys assessed value by the current tax rate. Chesterfield County Va Real Estate Tax Rate 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. SEE Detailed property tax report for 9400 Waterfall Cove Dr Chesterfield County VA. Please note that these assessment records are not the official assessment records of Chesterfield County.

Source:

Source:

Under Virginia State Law these real estate assessment records are public information. Please note that these assessment records are not the official assessment records of Chesterfield County. The Office of the Commissioner of the Revenue is responsible for administering a program for tax relief on real estate and mobile homes for eligible elderly and disabled residents of Chesterfield County. 2 per transaction total is applied to all credit card payments with the exception of debit cards which have a flat fee of 250 per transaction total. Chesterfield County Treasurers Office 9901 Lori Road Chesterfield VA 23832 804 748-1201 Chesterfield County Treasurers Tax Payment Portal.

Source: realtor.com

Source: realtor.com

Any errors or omissions should be reported for investigation. Chesterfield County levies a tax each calendar year on personal property with situs in the county. These fees are charged by MSB our online payment processor and are not part of your tax. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. The Office of the Commissioner of the Revenue is responsible for administering a program for tax relief on real estate and mobile homes for eligible elderly and disabled residents of Chesterfield County.

Source: realtor.com

Source: realtor.com

Chesterfield County Va Real Estate Tax Rate 22 days ago Houses 5 days ago The median property tax also known as real estate tax in Chesterfield County is 196400 per year based on a median home value of 23560000 and a median effective property tax rate of 083 of property value. The County does not receive any portion of these fees. Chesterfield County South Carolina 3 days ago The median property tax also known as real estate tax in Chesterfield County is 29300 per year based on a median home value of 7760000 and a median effective property tax rate of 038 of property value. In Chesterfield County a propertys assessed value is calculated by multiplying the market value with an assessment ratio which currently according to The State Code is set to. Choose any county from the list below or see South Carolina property tax by county to see property tax information for all South Carolina counties on one page.

Source: realtor.com

Source: realtor.com

You may be eligible if you. We have real estate tax tax information for a total of forty-six South Carolina counties in addition to Chesterfield County. Under Virginia State Law these real estate assessment records are public information. All property must first be registered with the Virginia Department of Motor Vehicles DMV. The Office of the Commissioner of the Revenue is responsible for administering a program for tax relief on real estate and mobile homes for eligible elderly and disabled residents of Chesterfield County.

Source: realtor.com

Source: realtor.com

Real Estate Records The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. You may be eligible if you. Pay Personal Property Real Estate Taxes Pay for your real estate and personal property taxes online. The Virginia Tax Code represents the main legal document regarding taxation. Real estate taxes are calculated by multiplying the propertys assessed value by the current tax rate.

Source: realtor.com

Source: realtor.com

Chesterfield County South Carolina 3 days ago The median property tax also known as real estate tax in Chesterfield County is 29300 per year based on a median home value of 7760000 and a median effective property tax rate of 038 of property value. All property must first be registered with the Virginia Department of Motor Vehicles DMV. The Office of the Commissioner of the Revenue is responsible for administering a program for tax relief on real estate and mobile homes for eligible elderly and disabled residents of Chesterfield County. Under Virginia State Law these real estate assessment records are public information. No warranties expressed or implied are provided for the data herein its.

Source: realtor.com

Source: realtor.com

Real Estate Records The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. For example if the tax rate is 095 per 100 of assessed value and. Real Estate Records The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. Any errors or omissions should be reported for investigation. Please note that these assessment records are not the official assessment records of Chesterfield County.

Source: realtor.com

Source: realtor.com

For example if the tax rate is 095 per 100 of assessed value and. Please note that these assessment records are not the official assessment records of Chesterfield County. Choose any county from the list below or see South Carolina property tax by county to see property tax information for all South Carolina counties on one page. Real Estate Records The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. All property must first be registered with the Virginia Department of Motor Vehicles DMV.

12 行 Personal Property Tax and First Half Real Estate Tax Due June 7 Second Quarter State. Chesterfield County Treasurers Office 9901 Lori Road Chesterfield VA 23832 804 748-1201 Chesterfield County Treasurers Tax Payment Portal. 2 per transaction total is applied to all credit card payments with the exception of debit cards which have a flat fee of 250 per transaction total. These fees are charged by MSB our online payment processor and are not part of your tax. The County does not receive any portion of these fees.

Source: realtor.com

Source: realtor.com

However this material may be slightly dated which would have an impact on its accuracy. The only exception to this is for boats which must be registered with the Virginia Department of Wildlife Resources DWR or the US. In Chesterfield County a propertys assessed value is calculated by multiplying the market value with an assessment ratio which currently according to The State Code is set to. Chesterfield County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Chesterfield County Virginia. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended.

Source: realtor.com

Source: realtor.com

Chesterfield County South Carolina 3 days ago The median property tax also known as real estate tax in Chesterfield County is 29300 per year based on a median home value of 7760000 and a median effective property tax rate of 038 of property value. You may redeem your property by paying to the person officially charged with the collection of taxes assessments penalties and cost together with 3 6 9 or 12 interest for 1. Chesterfield County South Carolina - Assessors Office The Chesterfield County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Chesterfield County South Carolina. The Chesterfield County - SC Tax Office makes every effort to produce and publish the most accurate information possible. Choose any county from the list below or see South Carolina property tax by county to see property tax information for all South Carolina counties on one page.

Source: realtor.com

Source: realtor.com

You may redeem your property by paying to the person officially charged with the collection of taxes assessments penalties and cost together with 3 6 9 or 12 interest for 1. Display of this property information on the Internet is specifically authorized by the Code of Virginia 581-31222 as amended. Chesterfield County levies a tax each calendar year on personal property with situs in the county. Under Virginia State Law these real estate assessment records are public information. Pay Personal Property Real Estate Taxes Pay for your real estate and personal property taxes online.

These records can include Chesterfield County property tax assessments and. The Chesterfield County - SC Tax Office makes every effort to produce and publish the most accurate information possible. Property taxes are determined at local levels being used for schools fire and police protection public parks and other benefits. We have real estate tax tax information for a total of forty-six South Carolina counties in addition to Chesterfield County. You may redeem your property by paying to the person officially charged with the collection of taxes assessments penalties and cost together with 3 6 9 or 12 interest for 1.

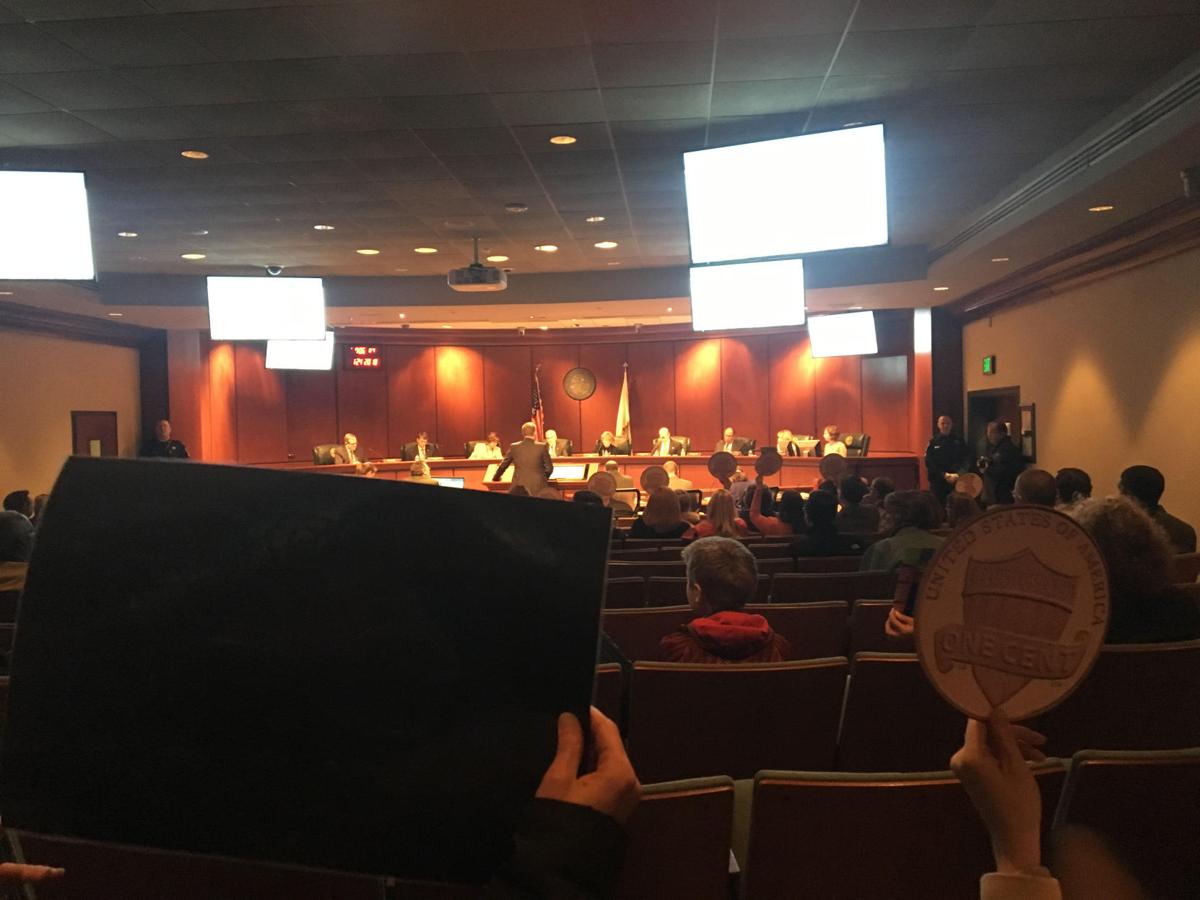

Source: richmond.com

Source: richmond.com

For example if the tax rate is 095 per 100 of assessed value and. Please note that these assessment records are not the official assessment records of Chesterfield County. Chesterfield County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Chesterfield County Virginia. The Virginia Tax Code represents the main legal document regarding taxation. We have real estate tax tax information for a total of forty-six South Carolina counties in addition to Chesterfield County.

Source: realtor.com

Source: realtor.com

Pay Personal Property Real Estate Taxes Pay for your real estate and personal property taxes online. You may redeem your property by paying to the person officially charged with the collection of taxes assessments penalties and cost together with 3 6 9 or 12 interest for 1. The only exception to this is for boats which must be registered with the Virginia Department of Wildlife Resources DWR or the US. The Chesterfield County - SC Tax Office makes every effort to produce and publish the most accurate information possible. Real Estate Records The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County.

Source: realtor.com

Source: realtor.com

Under Virginia State Law these real estate assessment records are public information. The median property tax in Chesterfield County Virginia is 1964 per year for a home worth the median value of 235600. In Chesterfield County a propertys assessed value is calculated by multiplying the market value with an assessment ratio which currently according to The State Code is set to. The Virginia Tax Code represents the main legal document regarding taxation. These records can include Chesterfield County property tax assessments and.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title chesterfield county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.