Your Chatham county real estate taxes images are ready in this website. Chatham county real estate taxes are a topic that is being searched for and liked by netizens today. You can Download the Chatham county real estate taxes files here. Download all free vectors.

If you’re searching for chatham county real estate taxes images information connected with to the chatham county real estate taxes interest, you have come to the right site. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly search and find more informative video articles and images that match your interests.

Chatham County Real Estate Taxes. SEE Detailed property tax report for 1860 Tom Stevens Rd Chatham County NC. Taxes not paid in full on or before December 31 will accrue interest penalties and fees. The State Department of Revenue is responsible for listing appraising and assessing all real estate within the counties. Chatham County Tax Commissioner.

Chatham County Ga Recently Sold Homes Realtor Com From realtor.com

Chatham County Ga Recently Sold Homes Realtor Com From realtor.com

Chatham County collects on average 074 of a propertys assessed fair market value as property tax. Box 1809 Pittsboro NC 27312 List of Phone Numbers. The Chatham County Assessors Office located in Savannah Georgia determines the value of all taxable property in Chatham County GA. Assessed value represents 40 the assessment ratio in Chatham County of a propertys market value. This new website was designed to complement the Countys GIS Mapping site by providing faster and easier access to County Land Information through a database format. Online tax payment registration renewal page or visit the DMV website for other ways to pay taxes on a Registered Motor Vehicle Click here for the delinquent tax lists Chatham County North Carolina 12 East Street PO.

Our dedicated professional agents provide informed.

The land tax sale is held annually on the Courthouse steps usually during the month of August. The Chatham County Assessors Office located in Savannah Georgia determines the value of all taxable property in Chatham County GA. The State Department of Revenue is responsible for listing appraising and assessing all real estate within the counties. Chatham Countys 2019-2020 tax rate is 067 per 100 of assessed value. You can also view print or pay property taxes online with an e-check debit or credit card. Please reach out to us if you have questions or concerns.

Source: ratingwalls.blogspot.com

Source: ratingwalls.blogspot.com

There is no state property tax. Property tax in North Carolina is a locally assessed tax collected by the counties. A propertys assessed value represents a part of its market value. The State Department of Revenue is responsible for listing appraising and assessing all real estate within the counties. Yearly median tax in Chatham County The median property tax in Chatham County North Carolina is 1430 per year for a home worth the median value of 193900.

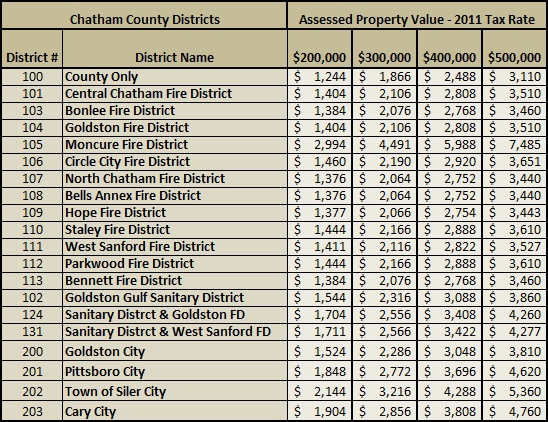

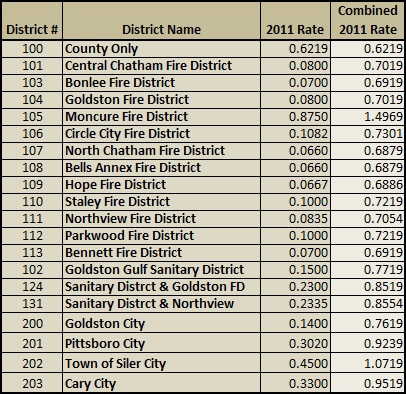

Additional rates apply for property located in towns and special districts. The tax for recording the note is at the rate of 150 for each 50000. The user hereby acknowledges that the information contained on this site is subject to change and cannot be guaranteed. Please direct any questions or comments about the data displayed here to ChathamtaxChathamcountyncgov. Property is subject to be sold at public auction for back taxes if the real estate taxes remain unpaid.

Source: chathamjournal.com

Source: chathamjournal.com

Information contained herein is provided for informational purposes only. Welcome to Chatham County Welcome to the new Chatham County website your gateway to both a responsive transparent and reform-minded government and to one of the most diverse historic beautiful and economically-vibrant counties in America. You can also view print or pay property taxes online with an e-check debit or credit card. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Chatham County Tax Commissioner.

Chatham Countys 2019-2020 tax rate is 067 per 100 of assessed value. A propertys assessed value represents a part of its market value. While efforts have been made to use the most current and accurate data Chatham County NC and Data Providers assume no legal responsibility for the use of the information contained herein. Additional rates apply for property located in towns and special districts. Assessed value represents 40 the assessment ratio in Chatham County of a propertys market value.

Source:

Source:

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Yearly median tax in Chatham County The median property tax in Chatham County North Carolina is 1430 per year for a home worth the median value of 193900. The Chatham County Tax Commissioners Office and Board of Assessors makes every effort to produce the most accurate information possible. Online tax payment registration renewal page or visit the DMV website for other ways to pay taxes on a Registered Motor Vehicle Click here for the delinquent tax lists Chatham County North Carolina 12 East Street PO. There is no state property tax.

Source: zillow.com

Source: zillow.com

Property is subject to be sold at public auction for back taxes if the real estate taxes remain unpaid. You can also view print or pay property taxes online with an e-check debit or credit card. Information contained herein is provided for informational purposes only. The Chatham County Assessors Office located in Savannah Georgia determines the value of all taxable property in Chatham County GA. Our contact information is below.

Source: savannah.com

Source: savannah.com

Real Estate and Tax Data Search. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. We have three local offices to better serve you in all areas of Chatham and Wake Counties. Chatham County Tax Commissioner.

Source: connectsavannah.com

Source: connectsavannah.com

Real Estate and Tax Data Search. SEE Detailed property tax report for 1860 Tom Stevens Rd Chatham County NC. This site provides information regarding land ownership and property taxes to the general public as well as the professional community. Chatham County Tax Commissioner. It is the foundation upon which taxing authorities determine the amount of real estate taxes to be paid.

Source: ratingwalls.blogspot.com

Source: ratingwalls.blogspot.com

Additional rates apply for property located in towns and special districts. Welcome to Chatham County Welcome to the new Chatham County website your gateway to both a responsive transparent and reform-minded government and to one of the most diverse historic beautiful and economically-vibrant counties in America. Your Hometown Choice Chatham Homes Realty puts you first. Chatham County collects on average 074 of a propertys assessed fair market value as property tax. Taxes not paid in full on or before December 31 will accrue interest penalties and fees.

Source: courier-tribune.com

Source: courier-tribune.com

Our contact information is below. This site provides information regarding land ownership and property taxes to the general public as well as the professional community. Property tax in North Carolina is a locally assessed tax collected by the counties. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Chatham County collects on average 074 of a propertys assessed fair market value as property tax.

Source: zillow.com

Source: zillow.com

The State Department of Revenue is responsible for listing appraising and assessing all real estate within the counties. SEE Detailed property tax report for 1860 Tom Stevens Rd Chatham County NC. Please reach out to us if you have questions or concerns. Chatham County Tax Commissioner. This new website was designed to complement the Countys GIS Mapping site by providing faster and easier access to County Land Information through a database format.

Source:

Source:

Cross-indexing to previous isntrument. Please direct any questions or comments about the data displayed here to ChathamtaxChathamcountyncgov. A propertys assessed value represents a part of its market value. The land tax sale is held annually on the Courthouse steps usually during the month of August. Chatham County collects on average 074 of a propertys assessed fair market value as property tax.

Source: zillow.com

Source: zillow.com

Property tax in North Carolina is a locally assessed tax collected by the counties. This new website was designed to complement the Countys GIS Mapping site by providing faster and easier access to County Land Information through a database format. Information contained herein is provided for informational purposes only. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. The Chatham County Tax Commissioners Office and Board of Assessors makes every effort to produce the most accurate information possible.

Source: ustaxdata.com

Source: ustaxdata.com

The user hereby acknowledges that the information contained on this site is subject to change and cannot be guaranteed. The user hereby acknowledges that the information contained on this site is subject to change and cannot be guaranteed. Additional rates apply for property located in towns and special districts. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Please direct any questions or comments about the data displayed here to ChathamtaxChathamcountyncgov.

Source: hallocklaw.com

Source: hallocklaw.com

Assessed value represents 40 the assessment ratio in Chatham County of a propertys market value. Please reach out to us if you have questions or concerns. This new website was designed to complement the Countys GIS Mapping site by providing faster and easier access to County Land Information through a database format. Chatham Countys 2019-2020 tax rate is 067 per 100 of assessed value. Assessed value represents 40 the assessment ratio in Chatham County of a propertys market value.

Source: ustaxdata.com

Source: ustaxdata.com

The State Department of Revenue is responsible for listing appraising and assessing all real estate within the counties. Information contained herein is provided for informational purposes only. The Chatham County Assessors Office located in Savannah Georgia determines the value of all taxable property in Chatham County GA. This site provides information regarding land ownership and property taxes to the general public as well as the professional community. The user hereby acknowledges that the information contained on this site is subject to change and cannot be guaranteed.

Source: zillow.com

Source: zillow.com

The tax for recording the note is at the rate of 150 for each 50000. SEE Detailed property tax report for 1860 Tom Stevens Rd Chatham County NC. Taxes not paid in full on or before December 31 will accrue interest penalties and fees. We have three local offices to better serve you in all areas of Chatham and Wake Counties. Free Chatham County Property Records Search.

Source: wral.com

Source: wral.com

This site provides information regarding land ownership and property taxes to the general public as well as the professional community. The land tax sale is held annually on the Courthouse steps usually during the month of August. SEE Detailed property tax report for 1860 Tom Stevens Rd Chatham County NC. Chatham Countys 2019-2020 tax rate is 067 per 100 of assessed value. Please reach out to us if you have questions or concerns.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title chatham county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.