Your Capital gains texas real estate images are available. Capital gains texas real estate are a topic that is being searched for and liked by netizens now. You can Get the Capital gains texas real estate files here. Get all free photos.

If you’re looking for capital gains texas real estate images information related to the capital gains texas real estate topic, you have pay a visit to the ideal site. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

Capital Gains Texas Real Estate. The good news is that the Texas cap on capital gains is 15. In reality this scenario happens to real estate investors all the time. 52 行 Calculate the capital gains tax on a sale of real estate property equipment stock mutual. 500000 of capital gains on real estate if youre married and filing jointly.

Pin On Austin Commercial Real Estate From pinterest.com

Pin On Austin Commercial Real Estate From pinterest.com

Capital gains taxes come into play when you sell your property at a profit or gain. If you buy a house for 100000 for example and sell the house for 150000 you must declare the 50000 difference as a capital gain for taxation. This asset can be anything a piece of art expensive jewelry a classic car or in this scenario your property. Capital gains tax on a primary residence If you sell your primary home it could be entitled to special treatment even if the sale gave you a six-figure profit. Which rate your capital. 250000 of capital gains on real estate if youre single.

Its like getting a 10000 bonus at work and only getting 7800 after taxes.

The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. In general any profit you make from selling a piece of real estate is subject to federal capital gains tax although the sale of a home is a big exception in most cases. When you sell a property that youve lived in for at least two of the last five years you qualify for the homeowner exemption also known as the Section 121 exclusion for real estate capital gains taxes. Texas has a 0 state capital gains tax. This asset can be anything a piece of art expensive jewelry a classic car or in this scenario your property. Single homeowners pay no.

Source: taxfoundation.org

Source: taxfoundation.org

However it does have a combined rate of 25 which takes into consideration the Federal capital gains rate the 38 Surtax on capital gains and the marginal effect of Pease Limitations. When you sell a property that youve lived in for at least two of the last five years you qualify for the homeowner exemption also known as the Section 121 exclusion for real estate capital gains taxes. With real estate it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. If your income falls between 80000 and 441450 your capital gains tax rate as a single person is 15. How long you owned the property and your income tax bracket.

When you sell a property in Texas the profits or capital gains on that property equal the selling price of the property minus the original price that you paid for the property. However its not as simple as. When you sell a property that youve lived in for at least two of the last five years you qualify for the homeowner exemption also known as the Section 121 exclusion for real estate capital gains taxes. In reality this scenario happens to real estate investors all the time. The resulting number is your capital gain.

Source: pinterest.com

Source: pinterest.com

Also keep in mind that in the state of Texas the most you can be taxed is 20 percent on your home sale. For example if you bought a home 10 years ago for 200000. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. The amount of the tax is included on the HUD-1 settlement forms. If your income falls between 80000 and 441450 your capital gains tax rate as a single person is 15.

Source: pinterest.com

Source: pinterest.com

500000 of capital gains on real estate if youre married and filing jointly. All About Capital Gains Tax On Rental Properties. How long you owned the property and your income tax bracket. The amount of the tax is included on the HUD-1 settlement forms. Also keep in mind that in the state of Texas the most you can be taxed is 20 percent on your home sale.

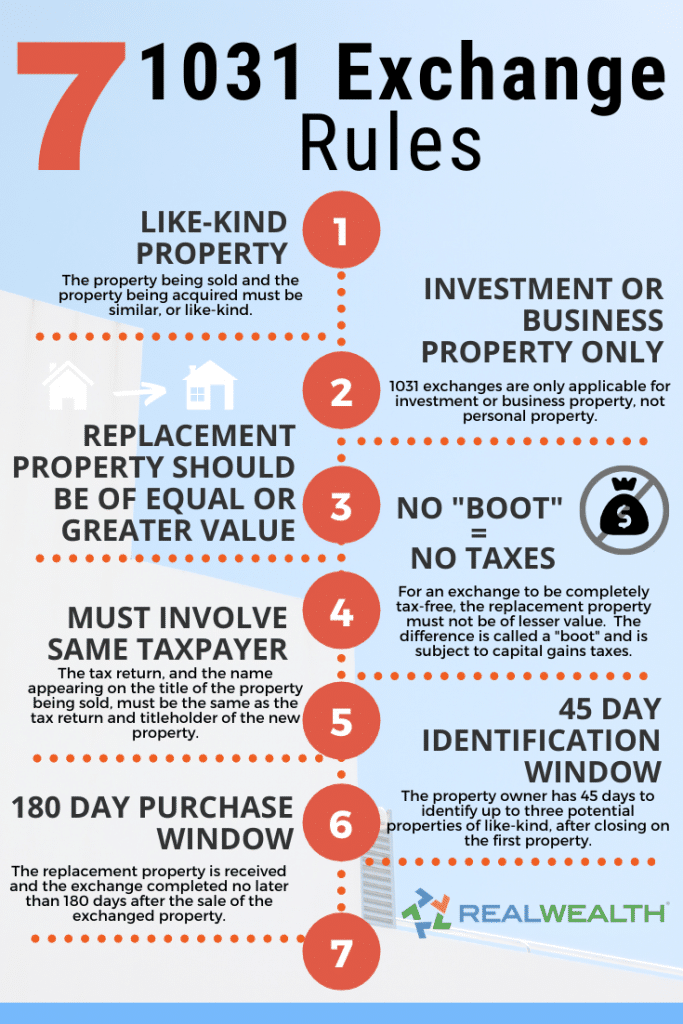

Source: realwealthnetwork.com

Source: realwealthnetwork.com

The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. When you sell an asset for profit the money made from the sale needs to be reported that year as taxable income. The good news is there are ways for real estate investors to offset capital gains and minimize getting. Capital gains tax on a primary residence If you sell your primary home it could be entitled to special treatment even if the sale gave you a six-figure profit. Up to 250000 in capital gains 500000 for a married couple on the home sale is exempt from taxation if you meet the following criteria.

Source: forbes.com

Source: forbes.com

All About Capital Gains Tax On Rental Properties. When you sell a property in Texas the profits or capital gains on that property equal the selling price of the property minus the original price that you paid for the property. The resulting number is your capital gain. With real estate it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. Also keep in mind that in the state of Texas the most you can be taxed is 20 percent on your home sale.

Source: listwithclever.com

Source: listwithclever.com

This asset can be anything a piece of art expensive jewelry a classic car or in this scenario your property. Capital gains tax is a tax on any profits made from the sale of an asset. Single homeowners pay no. For instance if you were to sell your house for 200000 you would owe 40000 in capital gains taxes. When a real estate sale produces a taxable capital gain the tax rate you pay depends on two factors.

Source: upnest.com

Source: upnest.com

However it does have a combined rate of 25 which takes into consideration the Federal capital gains rate the 38 Surtax on capital gains and the marginal effect of Pease Limitations. However its not as simple as. Which rate your capital. In general any profit you make from selling a piece of real estate is subject to federal capital gains tax although the sale of a home is a big exception in most cases. The good news is there are ways for real estate investors to offset capital gains and minimize getting.

Source: elderlawanswers.com

Source: elderlawanswers.com

This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. If your income falls between 80000 and 441450 your capital gains tax rate as a single person is 15. All About Capital Gains Tax On Rental Properties. Capital gains tax is due on 50000 300000 profit - 250000 IRS exclusion. Capital gains tax on a primary residence If you sell your primary home it could be entitled to special treatment even if the sale gave you a six-figure profit.

Source: fool.com

Source: fool.com

1 You owned and lived in the home as your principal residence for two out of the last five years. Texas has a 0 state capital gains tax. The good news is that the Texas cap on capital gains is 15. The good news is there are ways for real estate investors to offset capital gains and minimize getting. 250000 of capital gains on real estate if youre single.

Source: listwithclever.com

Source: listwithclever.com

The calculator based on your input calculates both short term capital gains as well as long term capital gains tax. Capital gains tax is a tax on any profits made from the sale of an asset. Texas has a 0 state capital gains tax. Note that capital gains taxes are charged by the federal government so even in states like Texas that dont have a transfer tax youll still have to be aware of the capital gains tax if youre a seller. Also keep in mind that in the state of Texas the most you can be taxed is 20 percent on your home sale.

Source: realtor.com

Source: realtor.com

Capital gains tax is due on 50000 300000 profit - 250000 IRS exclusion. Texas has a 0 state capital gains tax. The amount of the tax is included on the HUD-1 settlement forms. When a real estate sale produces a taxable capital gain the tax rate you pay depends on two factors. 250000 of capital gains on real estate if youre single.

Source: four19properties.com

Source: four19properties.com

The amount of the tax is included on the HUD-1 settlement forms. Also keep in mind that in the state of Texas the most you can be taxed is 20 percent on your home sale. Capital gains taxes come into play when you sell your property at a profit or gain. The calculator based on your input calculates both short term capital gains as well as long term capital gains tax. Texas has a 0 state capital gains tax.

Source: pinterest.com

Source: pinterest.com

250000 of capital gains on real estate if youre single. When a real estate sale produces a taxable capital gain the tax rate you pay depends on two factors. When you sell an asset for profit the money made from the sale needs to be reported that year as taxable income. The amount of the tax is included on the HUD-1 settlement forms. Its like getting a 10000 bonus at work and only getting 7800 after taxes.

Source: newsilver.com

Source: newsilver.com

When you sell a property that youve lived in for at least two of the last five years you qualify for the homeowner exemption also known as the Section 121 exclusion for real estate capital gains taxes. Note that capital gains taxes are charged by the federal government so even in states like Texas that dont have a transfer tax youll still have to be aware of the capital gains tax if youre a seller. Which rate your capital. Capital gains tax is a tax on any profits made from the sale of an asset. With real estate it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price.

Source: pinterest.com

Source: pinterest.com

When you sell a property that youve lived in for at least two of the last five years you qualify for the homeowner exemption also known as the Section 121 exclusion for real estate capital gains taxes. However its not as simple as. If you buy a house for 100000 for example and sell the house for 150000 you must declare the 50000 difference as a capital gain for taxation. The good news is there are ways for real estate investors to offset capital gains and minimize getting. In reality this scenario happens to real estate investors all the time.

Source: fool.com

Source: fool.com

This asset can be anything a piece of art expensive jewelry a classic car or in this scenario your property. Capital gains taxes come into play when you sell your property at a profit or gain. For example if you bought a home 10 years ago for 200000. However its not as simple as. Texas has a 0 state capital gains tax.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

Single homeowners pay no. Single homeowners pay no. When you sell an asset for profit the money made from the sale needs to be reported that year as taxable income. The resulting number is your capital gain. Also keep in mind that in the state of Texas the most you can be taxed is 20 percent on your home sale.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title capital gains texas real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.