Your Capital gains tax ny state real estate images are ready. Capital gains tax ny state real estate are a topic that is being searched for and liked by netizens today. You can Download the Capital gains tax ny state real estate files here. Find and Download all royalty-free images.

If you’re looking for capital gains tax ny state real estate pictures information linked to the capital gains tax ny state real estate keyword, you have come to the right site. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

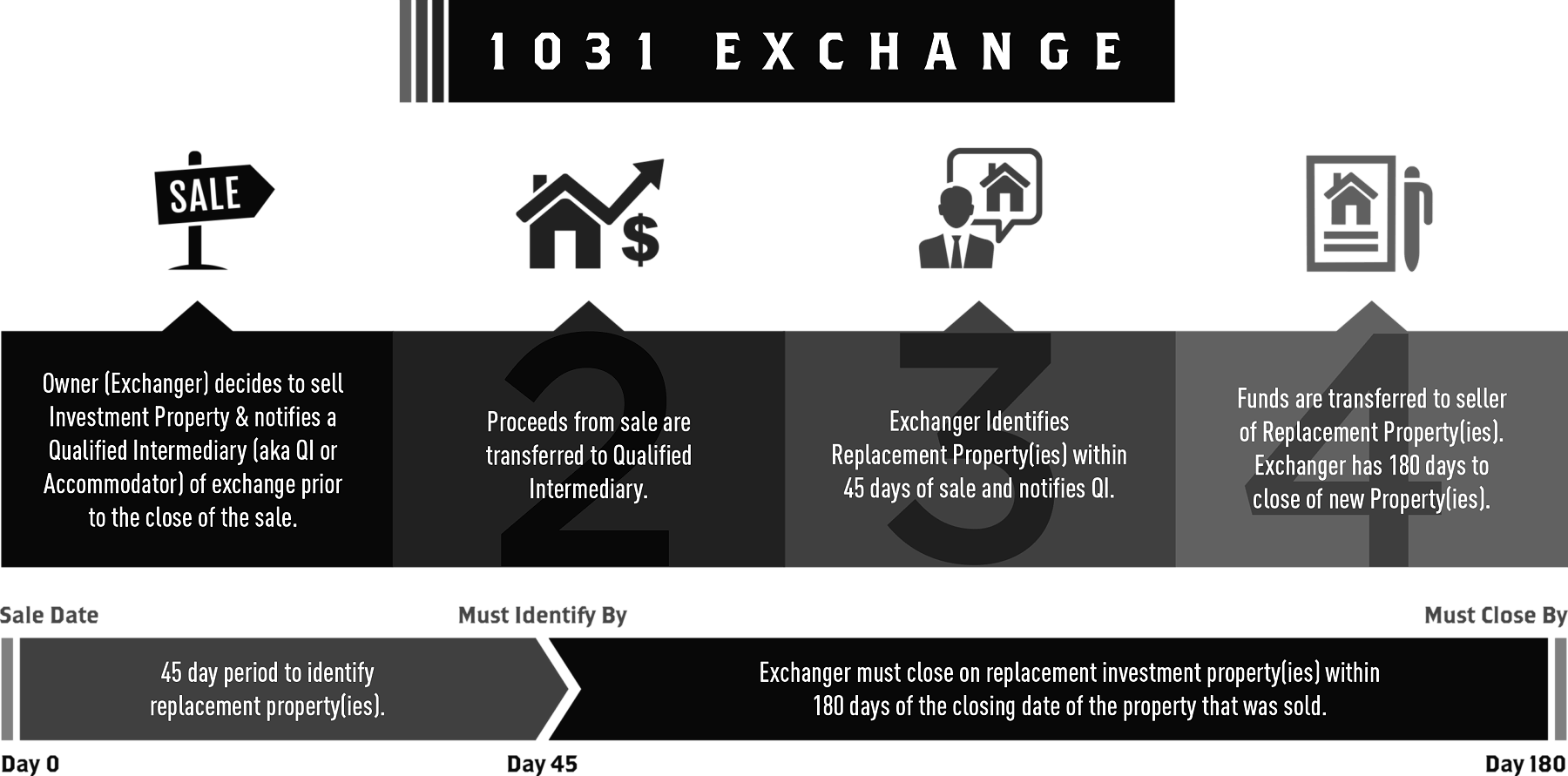

Capital Gains Tax Ny State Real Estate. The Internal Revenue Code Section 1031 Like-Kind Exchange provision allows an investor to reinvest the proceeds of an investment property in one or more like-kind properties and defer the capital gains tax. If you have sold real estate property you will have to report any. Capital Gains Tax on Sale of Property Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings. 52 行 Calculate the capital gains tax on a sale of real estate property equipment stock mutual.

How Much Tax Will I Pay If I Flip A House New Silver From newsilver.com

How Much Tax Will I Pay If I Flip A House New Silver From newsilver.com

Owning real estate produces steady income for investors but the sale of residential and business properties can generate a large tax bill because of capital gains. Capital Gains Tax on Sale of Property Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings. In addition expenses related to the sale of the real estate such as transfer taxes brokers commissions and legal fees further increase the tax basis. Whether you are unfamiliar with 1031. Most states tax capital gains according to the same tax rates they use for regular income. President Biden will propose doubling the top capital gains tax rate on investments like stocks and real estate according to a new report that sent stocks reeling Thursday.

Federal state and city capital gains tax calculator for New York City.

Federal state and city capital gains tax calculator for New York City. Capital Gains Tax Capital gains tax is the taxes levied on the profit arising from sale of the property. We have covered capital gains taxes for real estate investors and ways to use depreciation and 1031 exchanges in tax planning but these are not available to individuals. DTF-1004 Instructions on form Real Property Transfer Gains Tax Schedule of Units Shares or Parcels Transferred Before June 15 1996. A Guide Through the Tax Deferred Real Estate Investment Process. NYC Real Estate Taxes Selling New York City real estate can be a very complicated processjust as complicted as purchasing New York City real estateparticularly from the perspective of taxes and exemptions.

Source: itep.org

Source: itep.org

Download Free 28-Page Booklet - 1031. DTF-1004 Instructions on form Real Property Transfer Gains Tax Schedule of Units Shares or Parcels Transferred Before June 15 1996. A Complete Guide to Capital Gains Tax on Real Estate Sales If you recently sold a property or are planning to heres what you need to know about the potential tax. Assuming the owner has owned the property for more than 1 year capital gains tax ranges from 22 percent if property is held individually to 30 percent if property is. Real Estate Talks with Pierre Debbas.

Source: taxfoundation.org

Source: taxfoundation.org

Capital Gains Tax Capital gains tax is the taxes levied on the profit arising from sale of the property. Most state governments actually take a harder stance than the IRS on capital gains from real estate charging income taxes at the normal tax rate. Capital Gains Taxes in New York The most important tax issue to be aware of when buying or selling a home in New York is capital gainsCapital gains are defined as the profits you make as a result of a real estate or. Thiis is a table list the capital gains tax rate for every state in the country. The Net Investment Income Tax NIIT is an additional tax of 38.

Source: upnest.com

Source: upnest.com

Whether you are planning on purchasing or selling a home it is essential to learn about capital gains and how you can mitigate your liability. Whether you are unfamiliar with 1031. A Guide Through the Tax Deferred Real Estate Investment Process. If you sell your. This form has been discontinued.

Source: hauseit.com

Source: hauseit.com

Determining Real Estate Capital Gains When trying to estimate whether or not you will be subject to capital gains taxes on transactions involving real estate in New York you should keep in-mind that the key determining factors. Most states tax capital gains according to the same tax rates they use for regular income. So if youre lucky enough to live somewhere with no state income tax you wont have to worry about capital gains taxes at the state level. The Internal Revenue Code Section 1031 Like-Kind Exchange provision allows an investor to reinvest the proceeds of an investment property in one or more like-kind properties and defer the capital gains tax. Most state governments actually take a harder stance than the IRS on capital gains from real estate charging income taxes at the normal tax rate.

Source: realtor.com

Source: realtor.com

Nine states charge a lower long-term capital gains tax rate however similar to the federal government. Owning real estate produces steady income for investors but the sale of residential and business properties can generate a large tax bill because of capital gains. And since the tax basis is the starting point for determining capital gains tax it. Real Estate Talks with Pierre Debbas. Determining Real Estate Capital Gains When trying to estimate whether or not you will be subject to capital gains taxes on transactions involving real estate in New York you should keep in-mind that the key determining factors.

NYC Real Estate Taxes Selling New York City real estate can be a very complicated processjust as complicted as purchasing New York City real estateparticularly from the perspective of taxes and exemptions. We have covered capital gains taxes for real estate investors and ways to use depreciation and 1031 exchanges in tax planning but these are not available to individuals. NYC Real Estate Taxes Selling New York City real estate can be a very complicated processjust as complicted as purchasing New York City real estateparticularly from the perspective of taxes and exemptions. Most state governments actually take a harder stance than the IRS on capital gains from real estate charging income taxes at the normal tax rate. The following is a list of various potential tax obligations and exemptions that sellers should be aware of in case any one of these various scenarios apply to them.

Source: newsweek.com

Source: newsweek.com

Capital Gains Taxes in New York The most important tax issue to be aware of when buying or selling a home in New York is capital gainsCapital gains are defined as the profits you make as a result of a real estate or. A Guide Through the Tax Deferred Real Estate Investment Process. So if you have sold or are selling a house what does this mean for you. Capital Gains Tax Capital gains tax is the taxes levied on the profit arising from sale of the property. Real Estate Talks with Pierre Debbas.

Source: manhattanmiami.com

Source: manhattanmiami.com

Capital Gains Tax Capital gains tax is the taxes levied on the profit arising from sale of the property. Real Estate Talks with Pierre Debbas. So if you have sold or are selling a house what does this mean for you. Federal state and city capital gains tax calculator for New York City. If you sell your.

Source: forbes.com

Source: forbes.com

Estimate real estate capital gains taxes for selling a condo co-op or house in NYC. Arizona Arkansas Hawaii Montana New Mexico North Dakota South Carolina Vermont and Wisconsin. Download Free 28-Page Booklet - 1031. So if you have sold or are selling a house what does this mean for you. Thiis is a table list the capital gains tax rate for every state in the country.

Source: newsilver.com

Source: newsilver.com

Nine states charge a lower long-term capital gains tax rate however similar to the federal government. Estimate real estate capital gains taxes for selling a condo co-op or house in NYC. If you have sold real estate property you will have to report any. Whether you are planning on purchasing or selling a home it is essential to learn about capital gains and how you can mitigate your liability. Assuming the owner has owned the property for more than 1 year capital gains tax ranges from 22 percent if property is held individually to 30 percent if property is.

Real Property Transfer Gains Tax Final Computation. Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. Arizona Arkansas Hawaii Montana New Mexico North Dakota South Carolina Vermont and Wisconsin. So if youre lucky enough to live somewhere with no state income tax you wont have to worry about capital gains taxes at the state level. NYC Real Estate Taxes Selling New York City real estate can be a very complicated processjust as complicted as purchasing New York City real estateparticularly from the perspective of taxes and exemptions.

Source: hauseit.com

Source: hauseit.com

And since the tax basis is the starting point for determining capital gains tax it. In addition expenses related to the sale of the real estate such as transfer taxes brokers commissions and legal fees further increase the tax basis. Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. DTF-1004 Instructions on form Real Property Transfer Gains Tax Schedule of Units Shares or Parcels Transferred Before June 15 1996. And since the tax basis is the starting point for determining capital gains tax it.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

So if youre lucky enough to live somewhere with no state income tax you wont have to worry about capital gains taxes at the state level. Nine states charge a lower long-term capital gains tax rate however similar to the federal government. Interview with Paul Massey Impact of Bidens Tax Plan on Real Estate Wednesday May 19 at 10am Our host Pierre Debbas of Romer Debbas LLP is joined by renowned commercial real estate broker and former NYC mayoral candidate Paul Massey CEO of B6 Real Estate Advisors. If you sell your. Capital Gains Tax on Sale of Property Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings.

Source: hauseit.com

Source: hauseit.com

Capital Gains Tax on Sale of Property Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings. So if you have sold or are selling a house what does this mean for you. Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. Estimate real estate capital gains taxes for selling a condo co-op or house in NYC. If you have sold real estate property you will have to report any.

Source: financialsamurai.com

Source: financialsamurai.com

Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. The Net Investment Income Tax NIIT is an additional tax of 38. Download Free 28-Page Booklet - 1031. Owning real estate produces steady income for investors but the sale of residential and business properties can generate a large tax bill because of capital gains. Capital Gains Taxes in New York The most important tax issue to be aware of when buying or selling a home in New York is capital gainsCapital gains are defined as the profits you make as a result of a real estate or.

Source: hrblock.com

Source: hrblock.com

Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. Interview with Paul Massey Impact of Bidens Tax Plan on Real Estate Wednesday May 19 at 10am Our host Pierre Debbas of Romer Debbas LLP is joined by renowned commercial real estate broker and former NYC mayoral candidate Paul Massey CEO of B6 Real Estate Advisors. The Net Investment Income Tax NIIT is an additional tax of 38. If you have sold real estate property you will have to report any. Real Property Transfer Gains Tax Final Computation.

Real Estate Talks with Pierre Debbas. NYC Real Estate Taxes Selling New York City real estate can be a very complicated processjust as complicted as purchasing New York City real estateparticularly from the perspective of taxes and exemptions. This form has been discontinued. If you have sold real estate property you will have to report any. Most states tax capital gains according to the same tax rates they use for regular income.

Source: hackyourwealth.com

Source: hackyourwealth.com

Capital gains tax is the income tax you pay on gains from selling capital assetsincluding real estate. Thiis is a table list the capital gains tax rate for every state in the country. Federal state and city capital gains tax calculator for New York City. Estimate real estate capital gains taxes for selling a condo co-op or house in NYC. A Guide Through the Tax Deferred Real Estate Investment Process.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title capital gains tax ny state real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.