Your Capital gains tax canada real estate avoiding images are ready in this website. Capital gains tax canada real estate avoiding are a topic that is being searched for and liked by netizens now. You can Download the Capital gains tax canada real estate avoiding files here. Download all royalty-free photos.

If you’re searching for capital gains tax canada real estate avoiding images information connected with to the capital gains tax canada real estate avoiding interest, you have come to the ideal blog. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

Capital Gains Tax Canada Real Estate Avoiding. This is a great way to pass on financial support or gifts to family members while minimizing capital gains tax. When selling an inherited property you are liable for the taxation of 50 of the capital gains. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. You should also exclude this income when calculating your social benefits repayment.

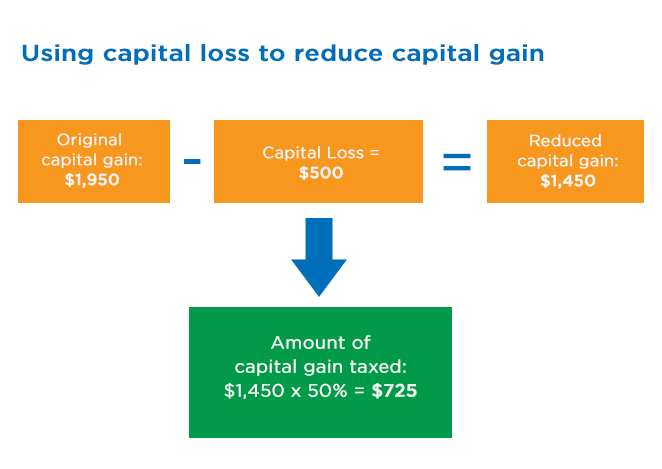

If at any time during the period you owned the property it was not your principal residence or solely your principal residence you might not be able to benefit from the principal residence exemption on all or part of the capital gain. While a capital gain will be subject to your marginal tax rate the capital gains tax allows you to shelter 50 of the profit from being taxed. Capital gains tax applies to all income generated from investments. Because 50 of the property is used for personal use you can shelter 50 of the 100000 capital gain. 3 2016 that all property sold during and after the 2016 tax year must be reported to the Canada Revenue Agency CRA. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

This is known as the incursion rate.

When selling your primary residence capital gains are not taxable. You should also exclude this income when calculating your social benefits repayment. However there is a way to mitigate or reduce the amount you pay. This is known as the incursion rate. What is Canadas Capital Gains Tax Rate. The amount of capital gains realized depends heavily on the favorability of the capital gains tax rate.

Source: wowa.ca

Source: wowa.ca

The capital gains tax rate in Ontario for the highest income bracket is 2676. Engage in tax-loss harvesting. If the value of the asset increases you have a capital gain and you need to pay tax on it. You have the ability to offset capital gains with. CRA is cracking down on income generated from real estate and in.

![]() Source: loanscanada.ca

Source: loanscanada.ca

In reality the capital gains tax doesnt apply directly to your capital gains but rather to the extra income youre making from them. No you dont have to pay taxes on your capital gains if you sell your house for more than you bought it for as long as it was your primary residence. This is a great way to pass on financial support or gifts to family members while minimizing capital gains tax. You can also offset your capital gains with capital. CRA is cracking down on income generated from real estate and in.

Source: hackyourwealth.com

Source: hackyourwealth.com

You should also exclude this income when calculating your social benefits repayment. A capital gains tax is a fee levied on the profits resulting from the sale of assets such as real estate properties stocks and bonds. If you owned this investment property for more than one year those capital gains will be taxed at the capital gains rates. Vancouver Real Estate Capital Gains In simple terms a capital gain is an increase in the value of an investment such as stocks or shares in a mutual fund or exchange traded fund or real estate holding from the original purchase price. In Canada up to 50 of the value of your capital gains may be subject to tax.

Capital gains from a mortgage foreclosure or a conditional sales repossession will be excluded from net income when calculating your claim for the goods and services taxharmonized sales tax credit the Canada child benefit credits allowed under certain related provincial or territorial programs and the age amount. These dependents have to pay at the same tax. Engage in tax-loss harvesting. A capital gains tax is a fee levied on the profits resulting from the sale of assets such as real estate properties stocks and bonds. Your capital gains are taxed at either 0 15 or 20.

Source: moneysense.ca

Source: moneysense.ca

In some cases capital gains tax could be avoided entirely. Capital gains tax applies to all income generated from investments. The loophole that allowed home flippers to avoid all taxes owed by just paying capital gains tax was closed as of January 1 2016. While a capital gain will be subject to your marginal tax rate the capital gains tax allows you to shelter 50 of the profit from being taxed. In reality the capital gains tax doesnt apply directly to your capital gains but rather to the extra income youre making from them.

Source: myexpattaxes.com

Source: myexpattaxes.com

These dependents have to pay at the same tax. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. You can also offset your capital gains with capital. The capital gains tax applies to any individual who sells a home to earn profits. The Capital Gains Tax Rates Capital gains tax rates are actually very straightforward.

Source: pinterest.com

Source: pinterest.com

A capital gain is defined as the difference between the selling price and the original cost. When selling an inherited property you are liable for the taxation of 50 of the capital gains. The passing of a primary residence through inheritance is considered a primary residence sale and as such there is no capital gains tax. How to reduce or avoid capital gains in Canada Use tax advantaged accounts. In some cases capital gains tax could be avoided entirely.

Source: financesofthenation.ca

Source: financesofthenation.ca

You should also exclude this income when calculating your social benefits repayment. Engage in tax-loss harvesting. Your capital gains are taxed at either 0 15 or 20. If youre interested to discover more about Avoid Capital Gains Tax on Real Estate LEGALLY please visit. What is a Capital Gains Tax.

Source: pinterest.com

Source: pinterest.com

In Canada up to 50 of the value of your capital gains may be subject to tax. As a result over half of capital gains are never taxed. However if you use the money to buy a new house where you would stay for long the government will not tax the earnings as a capital gain. If the value of the asset increases you have a capital gain and you need to pay tax on it. Because 50 of the property is used for personal use you can shelter 50 of the 100000 capital gain.

Source: pinterest.com

Source: pinterest.com

If the property was solely your principal residence for every year you owned it you do not have to pay tax on the gain. When you sell your home you may realize a capital gain. That might sound bad but trust us making money on your. If you owned this investment property for more than one year those capital gains will be taxed at the capital gains rates. Because 50 of the property is used for personal use you can shelter 50 of the 100000 capital gain.

Source: bccpa.ca

Source: bccpa.ca

For instance if you earn 80000 taxable income in Ontario and you sold a capital property. This is known as the incursion rate. This is a great way to pass on financial support or gifts to family members while minimizing capital gains tax. If you owned this investment property for more than one year those capital gains will be taxed at the capital gains rates. The Capital Gains Tax Rates Capital gains tax rates are actually very straightforward.

Source: in.pinterest.com

Source: in.pinterest.com

They are avoided completely. That might sound bad but trust us making money on your. This is known as the incursion rate. The capital gains tax rate in Ontario for the highest income bracket is 2676. For instance if you sold your cottage and realized a.

Source: pinterest.com

Source: pinterest.com

If youre interested to discover more about Avoid Capital Gains Tax on Real Estate LEGALLY please visit. The amount of capital gains realized depends heavily on the favorability of the capital gains tax rate. You should also exclude this income when calculating your social benefits repayment. For instance if you earn 80000 taxable income in Ontario and you sold a capital property. If at any time during the period you owned the property it was not your principal residence or solely your principal residence you might not be able to benefit from the principal residence exemption on all or part of the capital gain.

Source: floridarealtymarketplace.com

Source: floridarealtymarketplace.com

How to reduce or avoid capital gains in Canada Use tax advantaged accounts. Im sure most people understand capital gains if you buy something and it increases in value when you sell it you have to pay taxes on the profits. The loophole that allowed home flippers to avoid all taxes owed by just paying capital gains tax was closed as of January 1 2016. This is known as the incursion rate. If at any time during the period you owned the property it was not your principal residence or solely your principal residence you might not be able to benefit from the principal residence exemption on all or part of the capital gain.

Source: kalfalaw.com

Source: kalfalaw.com

One of the best ways to avoid or defer capital gains tax is by investing in a tax-sheltered account like an RRSP or TFSA. As a result over half of capital gains are never taxed. These dependents have to pay at the same tax. The Federal Government announced on Oct. How do I avoid capital gains tax in Canada.

Source: forbes.com

Source: forbes.com

What is a Capital Gains Tax. Note however that the tactic doesnt work well for gifting to children or students under the age of 24. This is generally a much more favorable rate than the ordinary income rate. A capital gain is defined as the difference between the selling price and the original cost. You can also offset your capital gains with capital.

Source: bccpa.ca

Source: bccpa.ca

How do I avoid capital gains tax in Canada. The Federal Government announced on Oct. Capital gains receive the most preferential tax treatment of dividends interest and. If at any time during the period you owned the property it was not your principal residence or solely your principal residence you might not be able to benefit from the principal residence exemption on all or part of the capital gain. Does capital gains tax apply only to real estate.

That might sound bad but trust us making money on your. One of the best ways to avoid or defer capital gains tax is by investing in a tax-sheltered account like an RRSP or TFSA. A capital gain is defined as the difference between the selling price and the original cost. This is generally a much more favorable rate than the ordinary income rate. Capital gains receive the most preferential tax treatment of dividends interest and.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title capital gains tax canada real estate avoiding by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.