Your California real estate bubble 2017 images are ready in this website. California real estate bubble 2017 are a topic that is being searched for and liked by netizens now. You can Find and Download the California real estate bubble 2017 files here. Find and Download all free vectors.

If you’re looking for california real estate bubble 2017 images information linked to the california real estate bubble 2017 keyword, you have visit the right blog. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

California Real Estate Bubble 2017. The market size of the real estate sector in 2017 was US120 billion which is expected to reach US1 trillion by 2030. Further the number of Californians 65 years of age and older increased 3 in 2019 alone. Lehman Brothers had assets on its. It is expected that the sector would have a.

Waco Real Estate Market Trends And Forecasts 2020 From noradarealestate.com

Waco Real Estate Market Trends And Forecasts 2020 From noradarealestate.com

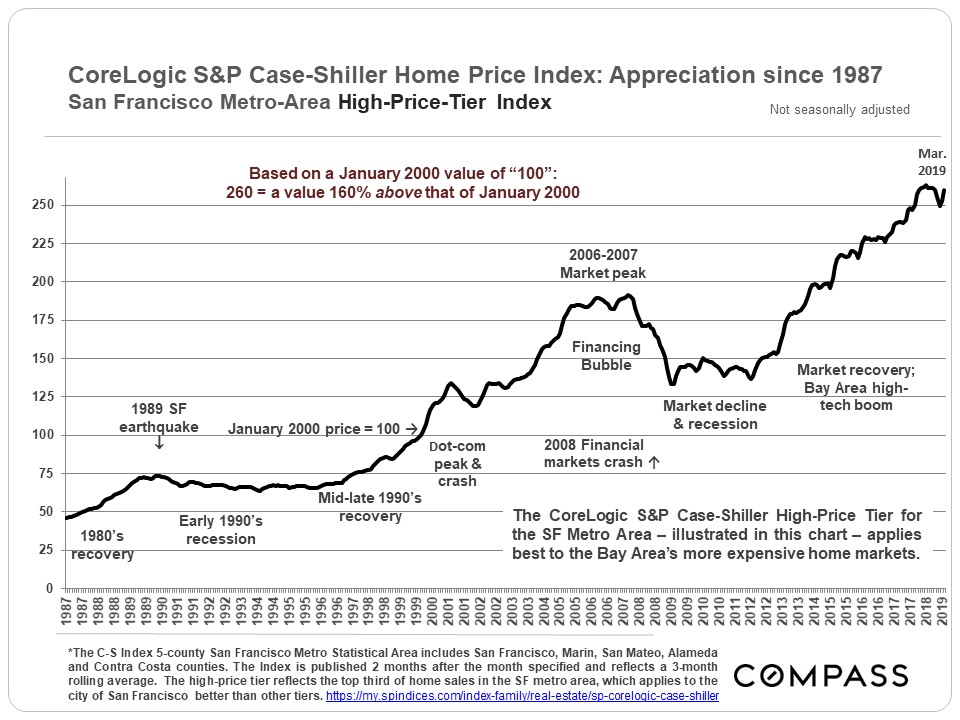

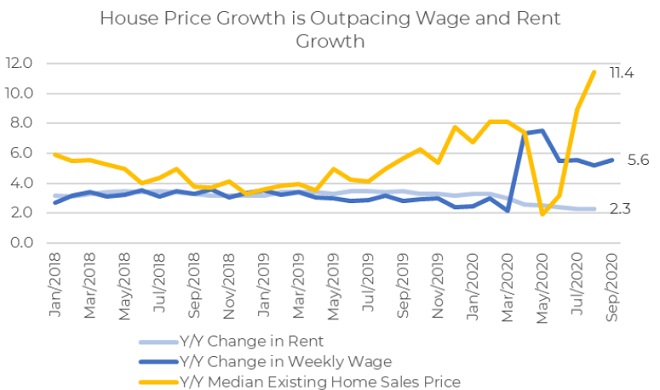

Later in outlying Bay Area counties. Santa Fe the state capital was another victim of the 2000s housing bubble peaking in March 2008 with a median home value of 324700 for the whole metro area. Ultra-low interest rates and fiscal spending had fueled a liquidity-driven housing bubble coupled with strong macro-economic domestic demand with nothing seen likely to. What is interesting is that once at the peak the median price stayed put for. Second home prices are surging in the face of stagnant household incomes. On the other hand the Dallas properties never lost value and in fact tripled in value 10 years later.

Roughly four-out-of-five Baby Boomers are homeowners today and will remain so in retirement though most will sell and downsize purchasing a replacement home of equal.

Later in outlying Bay Area counties. Santa Fe the state capital was another victim of the 2000s housing bubble peaking in March 2008 with a median home value of 324700 for the whole metro area. This information is designed for Real Estate Brokers and Office Managers to assist you in supporting your real estate business. That was of course one of the worst-hit markets in the Great Recession because it was also one of the biggest bubbles prior to the housing crash. There were 67 fewer homes for sale in California last month compared with March 2004 amid the height of the real estate bubble Realtor data show. A real estate bubble or property bubble or housing bubble for residential markets is a type of economic bubble that occurs periodically in local or global real estate markets and typically follow a land boom.

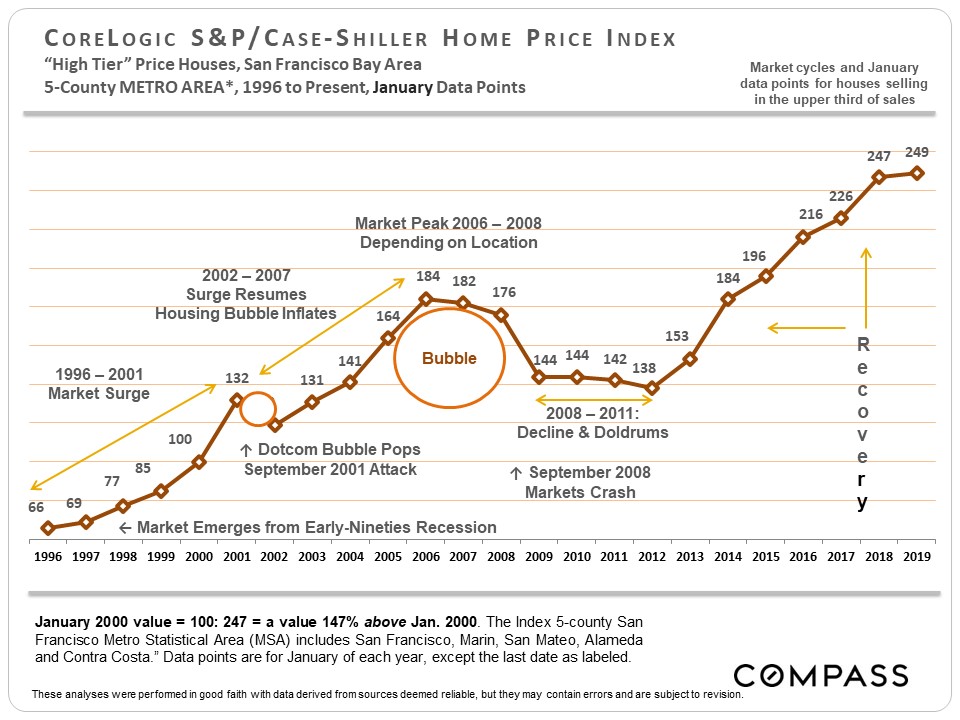

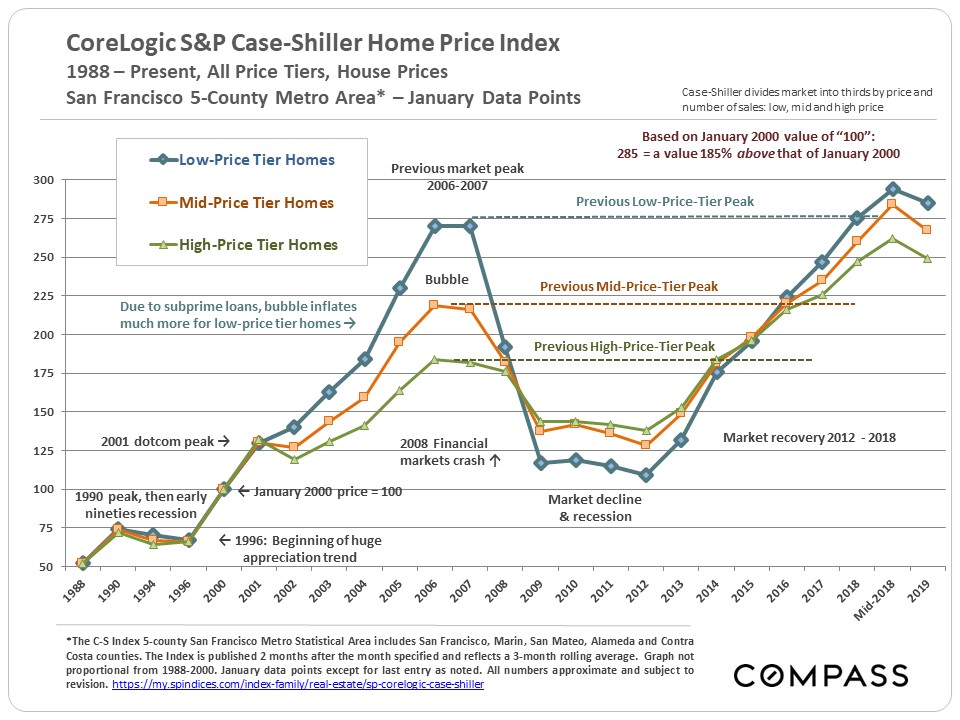

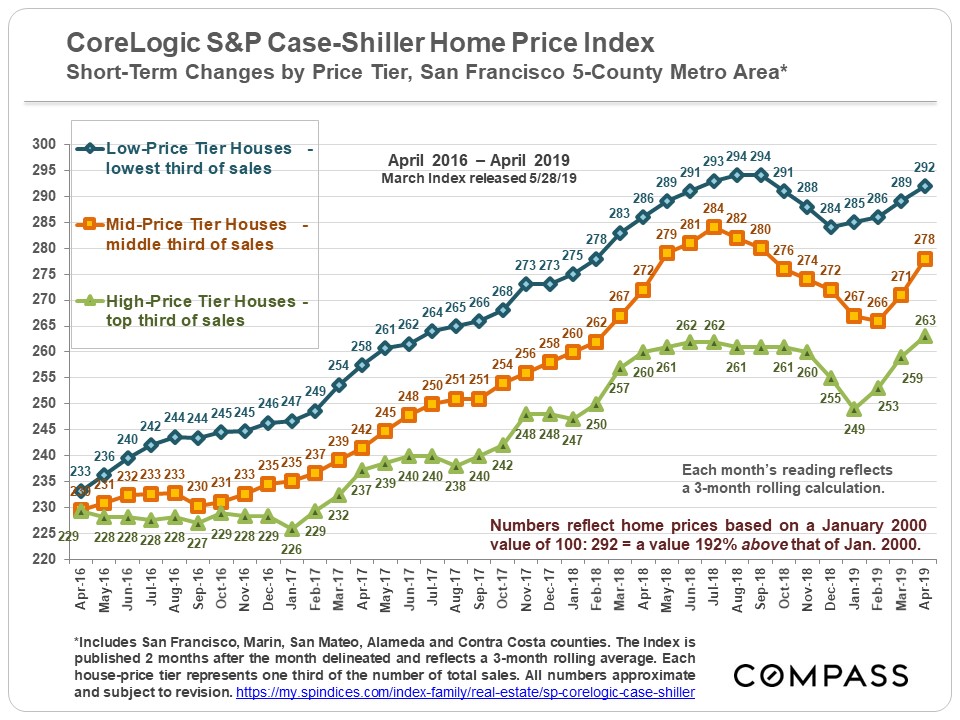

Source: bayareamarketreports.com

Source: bayareamarketreports.com

The Norris Groups 7th Annual Financial Tactics Brunch took place on October 28 2017. That is the biggest sign of a bubble. There were 67 fewer homes for sale in California last month compared with March 2004 amid the height of the real estate bubble Realtor data show. 34900 new and resale home transactions closed escrow in California during February 2021. Februarys relatively high sales numbers continue the rapid pace of sales experienced since mid-2020 uncharacteristic of.

Source: noradarealestate.com

Source: noradarealestate.com

A land boom is the of. Price changes and sales volume. 34900 new and resale home transactions closed escrow in California during February 2021. In this single month the number of homes sold was 23 higher than a year earlier. Second home prices are surging in the face of stagnant household incomes.

Source: bayareamarketreports.com

Source: bayareamarketreports.com

Lehman Brothers had assets on its. Second home prices are surging in the face of stagnant household incomes. A real estate bubble or property bubble or housing bubble for residential markets is a type of economic bubble that occurs periodically in local or global real estate markets and typically follow a land boom. Center for California Real Estate CCREs mission is to advance industry knowledge and innovation with an emphasis on convening key experts and influence-makers. California real estate market topping out.

Source: noradarealestate.com

Source: noradarealestate.com

Why some people are fleeing Southern California Another fat year for real estate. Second home prices are surging in the face of stagnant household incomes. Later in outlying Bay Area counties. Roughly four-out-of-five Baby Boomers are homeowners today and will remain so in retirement though most will sell and downsize purchasing a replacement home of equal. Price changes and sales volume.

Source: bayareamarketreports.com

Source: bayareamarketreports.com

Second home prices are surging in the face of stagnant household incomes. 34900 new and resale home transactions closed escrow in California during February 2021. Roughly four-out-of-five Baby Boomers are homeowners today and will remain so in retirement though most will sell and downsize purchasing a replacement home of equal. Ultra-low interest rates and fiscal spending had fueled a liquidity-driven housing bubble coupled with strong macro-economic domestic demand with nothing seen likely to. Topics covered included the new fiduciary rule and self-direct investing asset protection for real estate investors mistakes real estate investors make with IRA investing Trump tax law changes horror stories on 1031 exchanges.

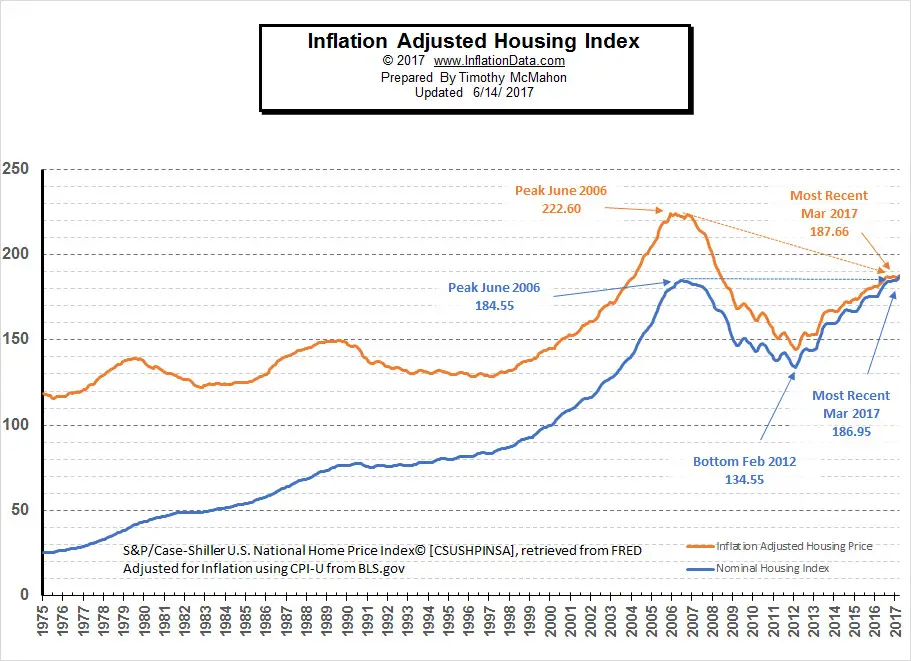

Source: inflationdata.com

Source: inflationdata.com

Second home prices are surging in the face of stagnant household incomes. Older Californians are growing in number at nearly 15 of the states population in 2019. A land boom is the of. Home values bottomed out at 249700 in April 2013 but have recovered since and now even exceed their previous peak by nearly 15 in Santa Fe. Topics covered included the new fiduciary rule and self-direct investing asset protection for real estate investors mistakes real estate investors make with IRA investing Trump tax law changes horror stories on 1031 exchanges.

Source: gordcollins.com

Source: gordcollins.com

Santa Fe the state capital was another victim of the 2000s housing bubble peaking in March 2008 with a median home value of 324700 for the whole metro area. Later in outlying Bay Area counties. In this single month the number of homes sold was 23 higher than a year earlier. Center for California Real Estate CCREs mission is to advance industry knowledge and innovation with an emphasis on convening key experts and influence-makers. Price changes and sales volume.

Source: bayareamarketreports.com

Source: bayareamarketreports.com

On the other hand the Dallas properties never lost value and in fact tripled in value 10 years later. In my opinion its a combination of unbelievably low mortgage rates and low inventories of affordable housing. Older Californians are growing in number at nearly 15 of the states population in 2019. Over the past 30 years the period between a recovery beginning and a bubble popping or a lesser adjustment occurring has run 5 to 7 years. Center for California Real Estate CCREs mission is to advance industry knowledge and innovation with an emphasis on convening key experts and influence-makers.

Source: zillow.com

Source: zillow.com

The market size of the real estate sector in 2017 was US120 billion which is expected to reach US1 trillion by 2030. First most Americans cant afford to buy a home without utilizing artificially low interest rates and even then they are stretching their budgets like spandex. There were 67 fewer homes for sale in California last month compared with March 2004 amid the height of the real estate bubble Realtor data show. A land boom is the of. Roughly four-out-of-five Baby Boomers are homeowners today and will remain so in retirement though most will sell and downsize purchasing a replacement home of equal.

Source: noradarealestate.com

Source: noradarealestate.com

California real estate market topping out. There were 67 fewer homes for sale in California last month compared with March 2004 amid the height of the real estate bubble Realtor data show. Home values bottomed out at 249700 in April 2013 but have recovered since and now even exceed their previous peak by nearly 15 in Santa Fe. Here in San Diego we all know that the housing market has really been booming. Price changes and sales volume.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

Second home prices are surging in the face of stagnant household incomes. Home values bottomed out at 249700 in April 2013 but have recovered since and now even exceed their previous peak by nearly 15 in Santa Fe. That is the biggest sign of a bubble. The Norris Groups 7th Annual Financial Tactics Brunch took place on October 28 2017. Santa Fe the state capital was another victim of the 2000s housing bubble peaking in March 2008 with a median home value of 324700 for the whole metro area.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

Center for California Real Estate CCREs mission is to advance industry knowledge and innovation with an emphasis on convening key experts and influence-makers. California real estate market topping out. Price changes and sales volume. Older Californians are growing in number at nearly 15 of the states population in 2019. The market size of the real estate sector in 2017 was US120 billion which is expected to reach US1 trillion by 2030.

Source: gordcollins.com

Source: gordcollins.com

In this single month the number of homes sold was 23 higher than a year earlier. Ultra-low interest rates and fiscal spending had fueled a liquidity-driven housing bubble coupled with strong macro-economic domestic demand with nothing seen likely to. California real estate market topping out. Six housing market predictions for 2017 84000 a year now qualifies as. That was of course one of the worst-hit markets in the Great Recession because it was also one of the biggest bubbles prior to the housing crash.

Source: wolfstreet.com

Source: wolfstreet.com

We are definitely in another housing bubble. What is interesting is that once at the peak the median price stayed put for. We are currently about 5 years into the current recovery which started in early 2012 in San Francisco. Roughly four-out-of-five Baby Boomers are homeowners today and will remain so in retirement though most will sell and downsize purchasing a replacement home of equal. First most Americans cant afford to buy a home without utilizing artificially low interest rates and even then they are stretching their budgets like spandex.

Source: bayareamarketreports.com

Source: bayareamarketreports.com

Lehman Brothers had assets on its. Topics covered included the new fiduciary rule and self-direct investing asset protection for real estate investors mistakes real estate investors make with IRA investing Trump tax law changes horror stories on 1031 exchanges. Februarys relatively high sales numbers continue the rapid pace of sales experienced since mid-2020 uncharacteristic of. 34900 new and resale home transactions closed escrow in California during February 2021. A real estate bubble or property bubble or housing bubble for residential markets is a type of economic bubble that occurs periodically in local or global real estate markets and typically follow a land boom.

Source: attomdata.com

Source: attomdata.com

Older Californians are growing in number at nearly 15 of the states population in 2019. That is the biggest sign of a bubble. In this single month the number of homes sold was 23 higher than a year earlier. Second home prices are surging in the face of stagnant household incomes. It is expected that the sector would have a.

Source: bayareamarketreports.com

Source: bayareamarketreports.com

Roughly four-out-of-five Baby Boomers are homeowners today and will remain so in retirement though most will sell and downsize purchasing a replacement home of equal. The Norris Groups 7th Annual Financial Tactics Brunch took place on October 28 2017. Six housing market predictions for 2017 84000 a year now qualifies as. It is expected that the sector would have a. Ultra-low interest rates and fiscal spending had fueled a liquidity-driven housing bubble coupled with strong macro-economic domestic demand with nothing seen likely to.

Source: gordcollins.com

Source: gordcollins.com

In this single month the number of homes sold was 23 higher than a year earlier. There were 67 fewer homes for sale in California last month compared with March 2004 amid the height of the real estate bubble Realtor data show. This amounted to a 155 percent increase over a six year window. The market size of the real estate sector in 2017 was US120 billion which is expected to reach US1 trillion by 2030. Older Californians are growing in number at nearly 15 of the states population in 2019.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title california real estate bubble 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.