Your Are proceeds from real estate transactions taxable images are available. Are proceeds from real estate transactions taxable are a topic that is being searched for and liked by netizens now. You can Find and Download the Are proceeds from real estate transactions taxable files here. Download all free photos and vectors.

If you’re looking for are proceeds from real estate transactions taxable pictures information connected with to the are proceeds from real estate transactions taxable interest, you have visit the right blog. Our site always gives you hints for viewing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Are Proceeds From Real Estate Transactions Taxable. The gross proceeds of the transaction include any cash the seller received or will receive. Hello I received a 1099-S proceeds from Real Estate Transactions from the PA. On the other hand if you held the asset for a year or less. The closing agent when the home was sold would have provided the form at the closing.

Irs Form 1099 S Software 79 Print 289 Efile 1099 S Software From 1099fire.com

Irs Form 1099 S Software 79 Print 289 Efile 1099 S Software From 1099fire.com

Hello I received a 1099-S proceeds from Real Estate Transactions from the PA. The property was in Florida. From within your TaxAct return Online or Desktop click on the Federal tab. I live in Massachusetts. When you sell a piece of real estate for a profit the Internal Revenue Service levies capital gains on your profit rather than on your actual proceeds from the sale. Houses 7 days ago Proceeds From Real Estate Transaction Yes you would include this on your tax return and it is considered a capital gain.

For a real estate transaction involving a residence enter the real estate tax paid in advance that is allocable to the buyer.

Buyers portion of the real estate tax. To report the sale of your main home. The gross proceeds of the transaction include any cash the seller received or will receive. Click Investment Income to expand the category and then click Gain or loss on sale of investments. A W-2 showing your income from your employer Form 1098 with the amount you paid in interest on a mortgage a 1098-E if you paid interest on student loans and Form 1099 with any amounts your received as an independent contractor or from interest on an investment to name a few. See reporting real estate for investment use below.

Source: businesstoday.in

Source: businesstoday.in

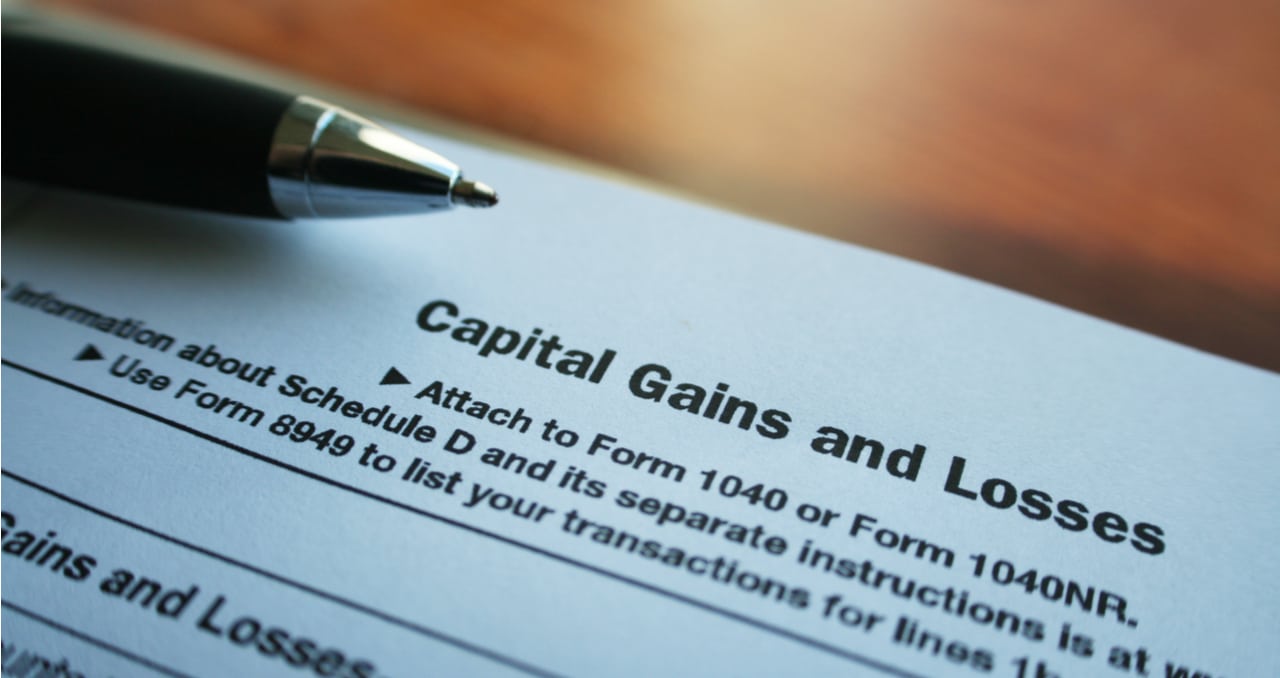

When you sell a piece of real estate for a profit the Internal Revenue Service levies capital gains on your profit rather than on your actual proceeds from the sale. From within your TaxAct return Online or Desktop click on the Federal tab. See reporting real estate for investment use below. Information about Form 1099-S Proceeds from Real Estate Transactions Info Copy Only including recent updates related forms and instructions on how to file. If more than one house is purchased or constructed exemption under Section 54 will be.

Source: rsm.de

Source: rsm.de

Reporting real estate for personal use. Information about Form 1099-S Proceeds from Real Estate Transactions Info Copy Only including recent updates related forms and instructions on how to file. It was for the sale of a mobile home and property and the proceeds were split with her two sons and my fathers son and I. A W-2 showing your income from your employer Form 1098 with the amount you paid in interest on a mortgage a 1098-E if you paid interest on student loans and Form 1099 with any amounts your received as an independent contractor or from interest on an investment to name a few. I live in Massachusetts.

Source: slidetodoc.com

Source: slidetodoc.com

On smaller devices click in the upper left-hand corner then select Federal. Unless your home was a rental at the time of sale or it was not your primary only then would you have received a 1099-S. The gross proceeds of the transaction include any cash the seller received or will receive. Proceeds From Real Estate Transaction Yes you would include this on your tax return and it is considered a capital gain. Capital Gains Tax on Seller Proceeds in Real Estate Transactions You know the forms.

Source: formswift.com

Source: formswift.com

Unless your home was a rental at the time of sale or it was not your primary only then would you have received a 1099-S. Houses 7 days ago Proceeds From Real Estate Transaction Yes you would include this on your tax return and it is considered a capital gain. Unless your home was a rental at the time of sale or it was not your primary only then would you have received a 1099-S. From within your TaxAct return Online or Desktop click Federal. On the other hand if you held the asset for a year or less.

Source: pinterest.com

Source: pinterest.com

Proceeds From Real Estate Transaction. Proceeds From Real Estate Transaction. Gross proceeds do not include the value of property or services received by the seller including separate cash payments for personal property like a washer and dryer included in the sale. On smaller devices click in the upper left-hand corner then select Federal. Capital Gains Tax on Seller Proceeds in Real Estate Transactions You know the forms.

Source: retipster.com

Source: retipster.com

To report proceeds for property considered to be a personal capital asset. If the 1099-S was for the sale of your main home complete the sale of home questions under the investment income topic in our program to see if any amounts are taxable. Information about Form 1099-S Proceeds from Real Estate Transactions Info Copy Only including recent updates related forms and instructions on how to file. From within your TaxAct return Online or Desktop click Federal. Capital Gains Tax on Seller Proceeds in Real Estate Transactions You know the forms.

Taxable Gain Rules for Real Estate Proceeds Budgeting. If the 1099-S was for the sale of your main home complete the sale of home questions under the investment income topic in our program to see if any amounts are taxable. File this form to report the sale or exchange of real estate. I live in Massachusetts. See reporting real estate for investment use below.

Source: fi.pinterest.com

Source: fi.pinterest.com

Proceeds From Real Estate Transaction Yes you would include this on your tax return and it is considered a capital gain. From within your TaxAct return Online or Desktop click on the Federal tab. The closing agent when the home was sold would have provided the form at the closing. For a real estate transaction involving a residence enter the real estate tax paid in advance that is allocable to the buyer. The gross proceeds of the transaction include any cash the seller received or will receive.

Source: ramquest.com

Source: ramquest.com

The basis of property inherited from a decedent is generally the fair market value of the property on the date of the decedents death. From within your TaxAct return Online or Desktop click on the Federal tab. An inheritance is not subject to income taxes. Click Investment Income to expand the category and then click Gain or loss on sale of investments. In addition to the rates listed in the table higher-income taxpayers may also have to pay an additional 38 net investment income tax.

Source: iclg.com

Source: iclg.com

To report proceeds for property considered to be a personal capital asset. In this case the capital gain or loss is reported on Form 8949 and Schedule D and the loss is allowed. The federal estate tax now applies only to a tiny minority of super-wealthy taxpayers estimated at about 2000 a year in total. Net proceeds are the amount received by the seller arising from the sale of an asset after all costs and expenses are deducted from the gross proceeds. I live in Massachusetts.

1099-S Proceeds From Real Estate Transactions trans. 1099-S Proceeds From Real Estate Transactions trans. On the other hand if you held the asset for a year or less. The closing agent when the home was sold would have provided the form at the closing. An inheritance is not subject to income taxes.

Source: 1099fire.com

Source: 1099fire.com

It was for the sale of a mobile home and property and the proceeds were split with her two sons and my fathers son and I. For a real estate transaction involving a residence enter the real estate tax paid in advance that is allocable to the buyer. Listing 8 Real Estate-Related Transaction That Are Tax Free. File this form to report the sale or exchange of real estate. If more than one house is purchased or constructed exemption under Section 54 will be.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

Houses 7 days ago Proceeds From Real Estate Transaction Yes you would include this on your tax return and it is considered a capital gain. Effective from assessment year 2015-16 exemption under Section 56 can be claimed only in respect of one residential house property purchasedconstructed in India. Hello I received a 1099-S proceeds from Real Estate Transactions from the PA. When you sell a piece of real estate for a profit the Internal Revenue Service levies capital gains on your profit rather than on your actual proceeds from the sale. To report proceeds for property considered to be a personal capital asset.

Source: pinterest.com

Source: pinterest.com

The basis of property inherited from a decedent is generally the fair market value of the property on the date of the decedents death. 1099-S Proceeds From Real Estate Transactions trans. Proceeds From Real Estate Transaction. For a real estate transaction involving a residence enter the real estate tax paid in advance that is allocable to the buyer. To report proceeds for property considered to be a personal capital asset.

Source: ramquest.com

Source: ramquest.com

The federal estate tax now applies only to a tiny minority of super-wealthy taxpayers estimated at about 2000 a year in total. If the 1099-S was for the sale of your main home complete the sale of home questions under the investment income topic in our program to see if any amounts are taxable. The basis of property inherited from a decedent is generally the fair market value of the property on the date of the decedents death. It was for the sale of a mobile home and property and the proceeds were split with her two sons and my fathers son and I. To report proceeds for property considered to be a personal capital asset.

Source: keepertax.com

Source: keepertax.com

Net proceeds are the amount received by the seller arising from the sale of an asset after all costs and expenses are deducted from the gross proceeds. If more than one house is purchased or constructed exemption under Section 54 will be. From within your TaxAct return Online or Desktop click on the Federal tab. The basis of property inherited from a decedent is generally the fair market value of the property on the date of the decedents death. File this form to report the sale or exchange of real estate.

Source: realestatewitch.com

Source: realestatewitch.com

See reporting real estate for investment use below. Hello I received a 1099-S proceeds from Real Estate Transactions from the PA. In addition to the rates listed in the table higher-income taxpayers may also have to pay an additional 38 net investment income tax. For example a residence is sold in a county where the real. File this form to report the sale or exchange of real estate.

Source: pinterest.com

Source: pinterest.com

Taxable Gain Rules for Real Estate Proceeds Budgeting. From within your TaxAct return Online or Desktop click on the Federal tab. Buyers portion of the real estate tax. The gross proceeds of the transaction include any cash the seller received or will receive. From within your TaxAct return Online or Desktop click Federal.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title are proceeds from real estate transactions taxable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.