Your Allegheny county real estate tax images are available. Allegheny county real estate tax are a topic that is being searched for and liked by netizens now. You can Find and Download the Allegheny county real estate tax files here. Find and Download all royalty-free photos.

If you’re looking for allegheny county real estate tax images information linked to the allegheny county real estate tax interest, you have visit the ideal site. Our website frequently gives you hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Allegheny County Real Estate Tax. 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200Allegheny County collects on. 48 行 Tax Collector Phone Millage 2019 Millage 2020 Value of 1 Mill 2020 Allegheny. Find Allegheny County property records deeds real estate tax assessment. 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200Allegheny County collects on.

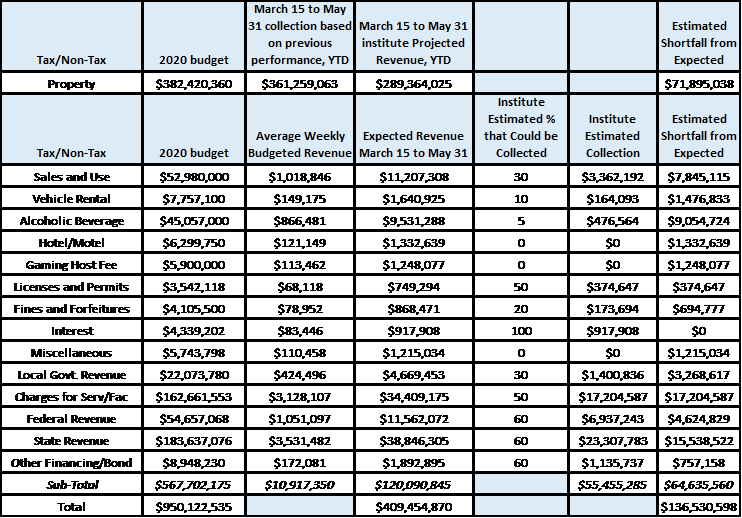

Allegheny County S 2021 Proposed Budget Allegheny Institute For Public Policy From alleghenyinstitute.org

Allegheny County S 2021 Proposed Budget Allegheny Institute For Public Policy From alleghenyinstitute.org

We maintain yearly records on over 550 thousand parcels. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. Allegheny County Real Estate Tax Real Estate Details. 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200Allegheny County collects on. Find Allegheny County Real Estate Tax Extension sold homes homes for sale real estate house for rent County treasurer extends real estate tax discount Houses 8 days ago Allegheny County Treasurer John Weinstein is extending a discount on real estate taxes until the end of April and suspending court enforcement for. You can pay for multiple properties in one transaction so have your parcel ID lotblock numbers handy.

Allegheny County has one of the highest median property taxes in the United States and is ranked 259th of the 3143 counties in order of median property taxes.

Find Allegheny County Real Estate Tax Extension sold homes homes for sale real estate house for rent County treasurer extends real estate tax discount Houses 8 days ago Allegheny County Treasurer John Weinstein is extending a discount on real estate taxes until the end of April and suspending court enforcement for. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner. Kane Community Living Centers. 3 Convenient ways to pay. Flat 30 discount of the real property tax on their primary residence for each year you are eligible. The vote allows The vote allows payments received or postmarked by April 30 th 2021 to be eligible to receive a 2 discount from the gross.

Source: anytimeestimate.com

Source: anytimeestimate.com

Treasurer Real Estate Taxes Allegheny County. Allegheny County Information Portal Home. Human Services and Care. Kane Community Living Centers. 48 行 Tax Collector Phone Millage 2019 Millage 2020 Value of 1 Mill 2020 Allegheny.

Source: anytimeestimate.com

Source: anytimeestimate.com

Allegheny County has contracted with Forte Systems to offer individuals and businesses the opportunity to pay real estate taxes directly over the internet. 48 行 Tax Collector Phone Millage 2019 Millage 2020 Value of 1 Mill 2020 Allegheny. Allegheny County Information Portal Home. Councils unanimous vote to extend the discounted real estate tax deadline by 30 days. Allegheny County collects on average 222 of a propertys assessed fair market value as property tax.

Source: post-gazette.com

Source: post-gazette.com

The median property tax also known as real estate tax in Allegheny County is 255300 per year based on a median home value of 11520000 and a median. Allegheny County Real Estate Tax Real Estate Details. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner. Find Allegheny County property records deeds real estate tax assessment. The vote allows The vote allows payments received or postmarked by April 30 th 2021 to be eligible to receive a 2 discount from the gross.

Source: anytimeestimate.com

Source: anytimeestimate.com

Allegheny County Real Estate Tax Real Estate Details. Allegheny County collects on average 222 of a propertys assessed fair market value as property tax. 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200Allegheny County collects on. The median property tax also known as real estate tax in Allegheny County is 255300 per year based on a median home value of 11520000 and a median. Find Allegheny County Real Estate Tax Extension sold homes homes for sale real estate house for rent County treasurer extends real estate tax discount Houses 8 days ago Allegheny County Treasurer John Weinstein is extending a discount on real estate taxes until the end of April and suspending court enforcement for.

Source: post-gazette.com

Source: post-gazette.com

Allegheny County Information Portal Home. Allegheny County has one of the highest median property taxes in the United States and is ranked 259th of the 3143 counties in order of median property taxes. Find Allegheny County Real Estate Tax Bills sold homes homes for sale real estate house for rent e-Payments and e-Billing Houses 2 days ago Easy Pay TAX PAYMENTS. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. Flat 30 discount of the real property tax on their primary residence for each year you are eligible.

Source: wesa.fm

Source: wesa.fm

The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner. Additionally receive the 2 discount by paying your county taxes in full by April 30th. Councils unanimous vote to extend the discounted real estate tax deadline by 30 days. Human Services and Care.

Source: anytimeestimate.com

Source: anytimeestimate.com

Allegheny County Information Portal Home. 48 行 Tax Collector Phone Millage 2019 Millage 2020 Value of 1 Mill 2020 Allegheny. The median property tax also known as real estate tax in Allegheny County is 255300 per year based on a median home value of 11520000 and a median. Allegheny County Information Portal Home. Allegheny County has contracted with Forte Systems to offer individuals and businesses the opportunity to pay real estate taxes directly over the internet.

Source: niche.com

Source: niche.com

Councils unanimous vote to extend the discounted real estate tax deadline by 30 days. Find Allegheny County Real Estate Tax Extension sold homes homes for sale real estate house for rent County treasurer extends real estate tax discount Houses 8 days ago Allegheny County Treasurer John Weinstein is extending a discount on real estate taxes until the end of April and suspending court enforcement for. Allegheny County has one of the highest median property taxes in the United States and is ranked 259th of the 3143 counties in order of median property taxes. Allegheny County has contracted with Forte Systems to offer individuals and businesses the opportunity to pay real estate taxes directly over the internet. Search Portals Land Records - Search deeds block and lot maps and other real estate records Real Estate - Search property value and tax.

Source: triblive.com

Source: triblive.com

You can pay for multiple properties in one transaction so have your parcel ID lotblock numbers handy. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. The vote allows The vote allows payments received or postmarked by April 30 th 2021 to be eligible to receive a 2 discount from the gross. Search Portals Land Records - Search deeds block and lot maps and other real estate records Real Estate - Search property value and tax. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner.

Source: alleghenyinstitute.org

Source: alleghenyinstitute.org

3 Convenient ways to pay. Human Services and Care. Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner. The median property tax also known as real estate tax in Allegheny County is 255300 per year based on a median home value of 11520000 and a median.

Source: anytimeestimate.com

Source: anytimeestimate.com

Find Allegheny County Real Estate Tax Extension sold homes homes for sale real estate house for rent County treasurer extends real estate tax discount Houses 8 days ago Allegheny County Treasurer John Weinstein is extending a discount on real estate taxes until the end of April and suspending court enforcement for. The median property tax also known as real estate tax in Allegheny County is 255300 per year based on a median home value of 11520000 and a median. Find Allegheny County Real Estate Tax Extension sold homes homes for sale real estate house for rent County treasurer extends real estate tax discount Houses 8 days ago Allegheny County Treasurer John Weinstein is extending a discount on real estate taxes until the end of April and suspending court enforcement for. Allegheny County Information Portal Home. 3 Convenient ways to pay.

Source: anytimeestimate.com

Source: anytimeestimate.com

Find Allegheny County Real Estate Tax Extension sold homes homes for sale real estate house for rent County treasurer extends real estate tax discount Houses 8 days ago Allegheny County Treasurer John Weinstein is extending a discount on real estate taxes until the end of April and suspending court enforcement for. 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200Allegheny County collects on. Allegheny County has contracted with Forte Systems to offer individuals and businesses the opportunity to pay real estate taxes directly over the internet. Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. Allegheny County collects on average 222 of a propertys assessed fair market value as property tax.

Source: alleghenyinstitute.org

Source: alleghenyinstitute.org

48 行 Tax Collector Phone Millage 2019 Millage 2020 Value of 1 Mill 2020 Allegheny. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner. Allegheny County collects on average 222 of a propertys assessed fair market value as property tax. Allegheny County has one of the highest median property taxes in the United States and is ranked 259th of the 3143 counties in order of median property taxes. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually.

Source: anytimeestimate.com

Source: anytimeestimate.com

Allegheny County has one of the highest median property taxes in the United States and is ranked 259th of the 3143 counties in order of median property taxes. Human Services and Care. 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200Allegheny County collects on. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner.

Source: alleghenycountytreasurer.us

Source: alleghenycountytreasurer.us

2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200Allegheny County collects on. 3 Convenient ways to pay. Search Portals Land Records - Search deeds block and lot maps and other real estate records Real Estate - Search property value and tax. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner. 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200Allegheny County collects on.

Source: anytimeestimate.com

Source: anytimeestimate.com

Allegheny County has contracted with Forte Systems to offer individuals and businesses the opportunity to pay real estate taxes directly over the internet. Find Allegheny County property records deeds real estate tax assessment. Human Services and Care. Allegheny County has contracted with Forte Systems to offer individuals and businesses the opportunity to pay real estate taxes directly over the internet. Find Allegheny County Real Estate Tax Bills sold homes homes for sale real estate house for rent e-Payments and e-Billing Houses 2 days ago Easy Pay TAX PAYMENTS.

Source: post-gazette.com

Source: post-gazette.com

Kane Community Living Centers. Allegheny County has one of the highest median property taxes in the United States and is ranked 259th of the 3143 counties in order of median property taxes. Additionally receive the 2 discount by paying your county taxes in full by April 30th. Councils unanimous vote to extend the discounted real estate tax deadline by 30 days. Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County.

Source: patch.com

Source: patch.com

Kane Community Living Centers. Search Portals Land Records - Search deeds block and lot maps and other real estate records Real Estate - Search property value and tax. Human Services and Care. We maintain yearly records on over 550 thousand parcels. 48 行 Tax Collector Phone Millage 2019 Millage 2020 Value of 1 Mill 2020 Allegheny.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title allegheny county real estate tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.