Your Allegheny county pa real estate tax assessment images are ready. Allegheny county pa real estate tax assessment are a topic that is being searched for and liked by netizens today. You can Get the Allegheny county pa real estate tax assessment files here. Find and Download all free images.

If you’re looking for allegheny county pa real estate tax assessment pictures information linked to the allegheny county pa real estate tax assessment keyword, you have come to the right site. Our website frequently gives you hints for viewing the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Allegheny County Pa Real Estate Tax Assessment. Looking for information on properties in Allegheny County. Land Records - Search deeds block and lot maps and other real estate records. The real estate taxes will recalculate based on the revised assessment and will estimate the tax savings. Real Estate Home Allegheny County.

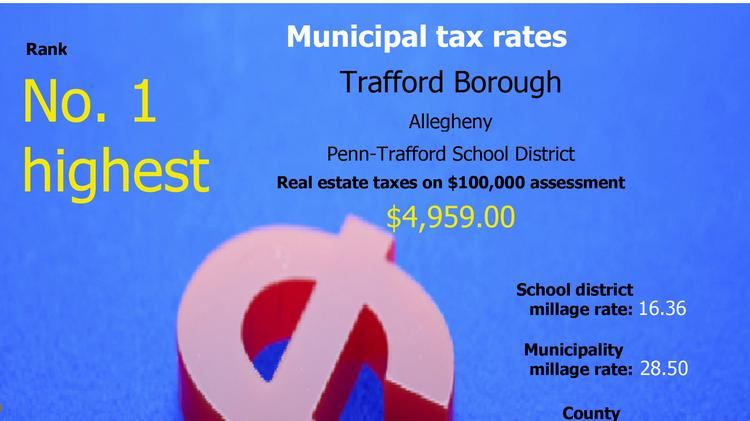

Allegheny County Property Tax Rates By Municipality Property Walls From propertywalls.blogspot.com

Allegheny County Property Tax Rates By Municipality Property Walls From propertywalls.blogspot.com

They are maintained by various. Houses 3 days ago Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. 473 mills or 473 per 10000 valuation Call 412-350-4100 or toll free 1-866-282-TAXS 8297 Annual Real Estate Tax. Allegheny County Property Records are real estate documents that contain information related to real property in Allegheny County Pennsylvania. Allegheny County property assessment appeal forms are available in person on the third floor of the County Office Building at 542 Forbes Avenue in downtown Pittsburgh PA 15219. Looking for information on properties in Allegheny County.

They are maintained by various.

The homestead exemption or reduction does not apply to the borough township or school district property taxes. This reduction reduces the tax paid to Allegheny County. We have tried to ensure that the information contained in this electronic search system is accurate. Allegheny County Treasurer Office. 473 mills or 473 per 10000 valuation Call 412-350-4100 or toll free 1-866-282-TAXS 8297 Annual Real Estate Tax. Choose the Allegheny County Municipality and enter the new or estimated assessment number in the New Total Value box and click calculate.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. Allegheny County Department Of Real Estate. Assessed Values by School District updated bi-weekly. Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the. Real Estate - Search property value and tax information.

Source: loc.gov

Source: loc.gov

Assessed Values by School District updated bi-weekly. Find information regarding COVID-19. Assessed Values by School District updated bi-weekly. This reduction reduces the tax paid to Allegheny County. The homestead exemption or reduction does not apply to the borough township or school district property taxes.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

The real estate taxes will recalculate based on the revised assessment and will estimate the tax savings. Land Records - Search deeds block and lot maps and other real estate records. They are maintained by various. Houses Just Now The Allegheny County Department Of Real Estate located in Pittsburgh Pennsylvania is a centralized office where public records are recorded indexed and stored in Allegheny County PA. Allegheny County property assessment appeal forms are available in person on the third floor of the County Office Building at 542 Forbes Avenue in downtown Pittsburgh PA 15219.

Source: anytimeestimate.com

Source: anytimeestimate.com

Allegheny County Treasurer Office. A property owner or any taxing entity in Allegheny County has the right to appeal a property. The homestead exemption or reduction does not apply to the borough township or school district property taxes. Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the county Real Estate Records and Property Assessments page. This reduction reduces the tax paid to Allegheny County.

Source: anytimeestimate.com

Source: anytimeestimate.com

This year in 2021 thousands of Allegheny County property tax assessment appeals were filed by by both taxing entities and commercial and residential property owners. Real Estate - Search property value and tax information. A property owner or any taxing entity in Allegheny County has the right to appeal a property. This reduction reduces the tax paid to Allegheny County. Registerpre-register for COVID Vaccine registrations.

Source: anytimeestimate.com

Source: anytimeestimate.com

Allegheny County 2021 Millage Rate. The taxing entities mainly the school districts filed property tax appeals against recent home buyers whose sale price was higher than their current property assessment. We have tried to ensure that the information contained in this electronic search system is accurate. Allegheny County Department Of Real Estate. You need to collect hotel tax.

Source: anytimeestimate.com

Source: anytimeestimate.com

The taxing entities mainly the school districts filed property tax appeals against recent home buyers whose sale price was higher than their current property assessment. The real estate taxes will recalculate based on the revised assessment and will estimate the tax savings. Allegheny County Department Of Real Estate. Allegheny County 2021 Millage Rate. A property owner or any taxing entity in Allegheny County has the right to appeal a property.

Assessed Values by School District updated bi-weekly. Find information regarding COVID-19. Choose the Allegheny County Municipality and enter the new or estimated assessment number in the New Total Value box and click calculate. Assessed Values by School District updated bi-weekly. Houses Just Now The Allegheny County Department Of Real Estate located in Pittsburgh Pennsylvania is a centralized office where public records are recorded indexed and stored in Allegheny County PA.

Source: anytimeestimate.com

Source: anytimeestimate.com

Allegheny County Treasurer Office. The homestead exemption or reduction does not apply to the borough township or school district property taxes. Allegheny County Treasurer Office. Allegheny County Department Of Real Estate. The taxing entities mainly the school districts filed property tax appeals against recent home buyers whose sale price was higher than their current property assessment.

Source: anytimeestimate.com

Source: anytimeestimate.com

Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the. The Allegheny Countys Department of Real Estate Office present the information on this web site as a service to the public. Find information regarding COVID-19. 473 mills or 473 per 10000 valuation Call 412-350-4100 or toll free 1-866-282-TAXS 8297 Annual Real Estate Tax. Allegheny County 2021 Millage Rate.

Source: anytimeestimate.com

Source: anytimeestimate.com

Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the. Land Records - Search deeds block and lot maps and other real estate records. Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the county Real Estate Records and Property Assessments page. Allegheny County tax appeal forms are also available during the relevant appeal period on the Allegheny County website here. The taxing entities mainly the school districts filed property tax appeals against recent home buyers whose sale price was higher than their current property assessment.

Source: kevindcampbell.ca

Source: kevindcampbell.ca

A property owner or any taxing entity in Allegheny County has the right to appeal a property. Allegheny County Department Of Real Estate. Find information regarding COVID-19. Allegheny County property assessment appeal forms are available in person on the third floor of the County Office Building at 542 Forbes Avenue in downtown Pittsburgh PA 15219. Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the.

Source: knapwell.info

Source: knapwell.info

You need to collect hotel tax. Houses Just Now The Allegheny County Department Of Real Estate located in Pittsburgh Pennsylvania is a centralized office where public records are recorded indexed and stored in Allegheny County PA. Assessed Values by Municipality updated bi-weekly. The reason is that Allegheny County allows a reduction in the assessed valuation for a Homestead exemption. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Source: en.wikipedia.org

Source: en.wikipedia.org

Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the. They are maintained by various. Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. Assessed Values by School District updated bi-weekly. A property owner or any taxing entity in Allegheny County has the right to appeal a property.

Allegheny County Department Of Real Estate. This reduction reduces the tax paid to Allegheny County. Find information regarding COVID-19. This year in 2021 thousands of Allegheny County property tax assessment appeals were filed by by both taxing entities and commercial and residential property owners. We have tried to ensure that the information contained in this electronic search system is accurate.

Source: sites.google.com

Source: sites.google.com

The Department of Real Estate Office makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link. Allegheny County 2021 Millage Rate. Looking for information on properties in Allegheny County. You need to collect hotel tax. A property owner or any taxing entity in Allegheny County has the right to appeal a property.

Source: alleghenycountytreasurer.us

Source: alleghenycountytreasurer.us

The homestead exemption or reduction does not apply to the borough township or school district property taxes. The purpose of the Recorder of Deeds is to ensure the accuracy of Allegheny County property and land records and to preserve their continuity. Real Estate - Search property value and tax information. Allegheny County property assessment appeal forms are available in person on the third floor of the County Office Building at 542 Forbes Avenue in downtown Pittsburgh PA 15219. We have tried to ensure that the information contained in this electronic search system is accurate.

Source: anytimeestimate.com

Source: anytimeestimate.com

The homestead exemption or reduction does not apply to the borough township or school district property taxes. Assessed Values by School District updated bi-weekly. Allegheny County property assessment appeal forms are available in person on the third floor of the County Office Building at 542 Forbes Avenue in downtown Pittsburgh PA 15219. 473 mills or 473 per 10000 valuation Call 412-350-4100 or toll free 1-866-282-TAXS 8297 Annual Real Estate Tax. Choose the Allegheny County Municipality and enter the new or estimated assessment number in the New Total Value box and click calculate.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title allegheny county pa real estate tax assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.