Your Adjusted basis formula real estate images are available. Adjusted basis formula real estate are a topic that is being searched for and liked by netizens today. You can Get the Adjusted basis formula real estate files here. Find and Download all royalty-free vectors.

If you’re looking for adjusted basis formula real estate images information connected with to the adjusted basis formula real estate keyword, you have pay a visit to the ideal blog. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

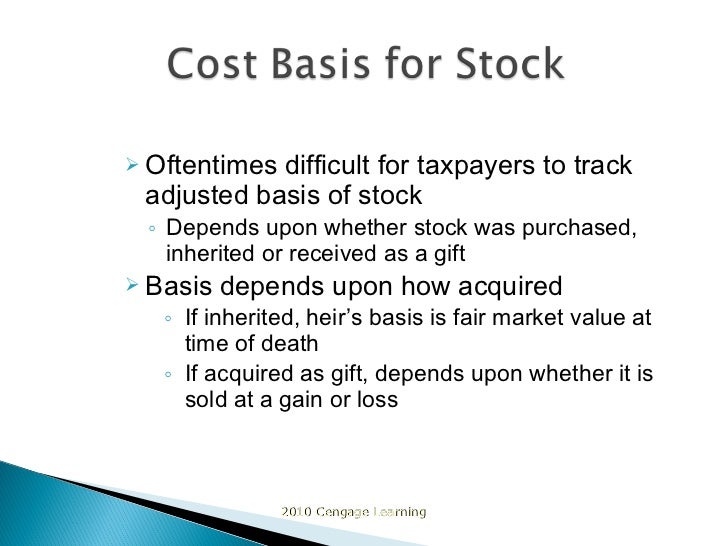

Adjusted Basis Formula Real Estate. What increases the basis of real property. Adjusted Basis Defined Basis in simple terms is defined as the amount that your property is worth for tax purposes. Common expenses that reduce an. Adjusted Basis and Basis are terms often used interchangeably by CPAs and tax professionals.

Selling A Rental That Was Once A Primary Residence Kakenmaster Tax Accounting From kakenmaster.com

Selling A Rental That Was Once A Primary Residence Kakenmaster Tax Accounting From kakenmaster.com

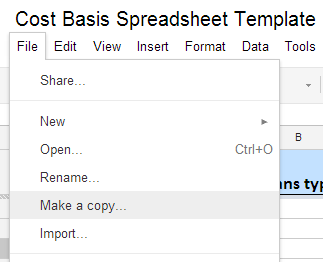

Select to solve for a different unknown. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation. Most non-registered investments require an adjusted cost base calculation. Add the cost of major improvements. Original basis or purchase price.

The adjusted basis of an asset is generally its purchase price plus capital improvements and costs of sale less any tax deductions you previously took for the property.

Adjusted basis of home sold. It represents the Cost Basis that has been adjusted over time either through increases andor decreases to basis. Start with the original investment in the property. Adjusted Cost Basis Assets Purchase Price Improvements Depreciation Deductions According to IRC Section 1016 the adjusted cost basis is the net cost of an asset after adjusting for increases in improvements to the property or decreases in. For instance a given asset purchased for 100 that is sold one year later after having experienced 10 in depreciation and 50 in improvements would have an adjusted basis of 100 - 10 50 140. Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset.

Source: fool.com

Source: fool.com

An assets adjusted basis takes the base price of an asset and adjusts it for changes in value reflecting enhancements and or depreciation. Your adjusted basis will be reduced by 100000 20000 depreciation per year multiplied by five years. The adjusted basis of an asset is generally its purchase price plus capital improvements and costs of sale less any tax deductions you previously took for the property. Calculate your adjusted basis by factoring in the change to your investment. 16 2 8 L 3.

Source: bankrate.com

Source: bankrate.com

You renovated your kitchen add the. Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation. Original basis or purchase price. Start with the original investment in the property. 305000 129000 176000 basis If you made improvements to the home Ex.

Source: kakenmaster.com

Source: kakenmaster.com

Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. This could include a rental property owned by an individual investor commercial real estate or the sale of securities such as stocks and bonds. Cumulative capital improvements depreciation. It represents the Cost Basis that has been adjusted over time either through increases andor decreases to basis.

Source: thetaxadviser.com

Source: thetaxadviser.com

Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset. Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price. Start with the original investment in the property. When the asset is sold the capital gain is determined by subtracting the adjusted cost base from the sale price of the asset. Cumulative capital improvements depreciation.

Adjusted basis of home sold. You renovated your kitchen add the. 305000 129000 176000 basis If you made improvements to the home Ex. Step 5 Determine cumulative depreciation on additions or capital improvements. Total Square Footage.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

When you first purchase a home the basis of the home also known as the cost basis or starting basis represents the amount you initially paid for. Adjusted Basis Defined Basis in simple terms is defined as the amount that your property is worth for tax purposes. 305000 129000 176000 basis If you made improvements to the home Ex. To find the adjusted basis. So in case of property that you got as inheritance cost basis is the purchase price plus any improvement cost that your ancestor incurred.

Source: novelinvestor.com

Source: novelinvestor.com

For example if you had bought 100 more shares of stock at 5 per share your adjusted basis would now be 1500. Most non-registered investments require an adjusted cost base calculation. To find the adjusted basis. Select to solve for a different unknown. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents.

Source: extension.iastate.edu

Source: extension.iastate.edu

You renovated your kitchen add the. Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price. Cumulative capital improvements depreciation. Common expenses that reduce an. The adjusted basis is simply the cost of your home adjusted for tax purposes by improvements youve made or deductions youve taken.

That is you add the 1000 you originally spent to the 500 you spent when you bought more shares. 305000 129000 176000 basis If you made improvements to the home Ex. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. Select to solve for a different unknown. Your adjusted basis will be reduced by 100000 20000 depreciation per year multiplied by five years.

Source: thetaxadviser.com

Source: thetaxadviser.com

An assets adjusted basis takes the base price of an asset and adjusts it for changes in value reflecting enhancements and or depreciation. Most non-registered investments require an adjusted cost base calculation. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. The adjusted basis of an asset is generally its purchase price plus capital improvements and costs of sale less any tax deductions you previously took for the property. Start with the original investment in the property.

Source: thetaxadviser.com

Source: thetaxadviser.com

Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation. Cumulative real estate depreciation. Subtract the amount of allowable depreciation and casualty and theft losses. Adjusted Basis and Basis are terms often used interchangeably by CPAs and tax professionals. 16 2 8 L 3.

Source: bankrate.com

Source: bankrate.com

The adjusted basis of an asset is generally its purchase price plus capital improvements and costs of sale less any tax deductions you previously took for the property. The adjusted basis is simply the cost of your home adjusted for tax purposes by improvements youve made or deductions youve taken. Most non-registered investments require an adjusted cost base calculation. It represents the Cost Basis that has been adjusted over time either through increases andor decreases to basis. Adjusted Basis and Basis are terms often used interchangeably by CPAs and tax professionals.

Source: extension.iastate.edu

Source: extension.iastate.edu

The adjusted basis of an asset is generally its purchase price plus capital improvements and costs of sale less any tax deductions you previously took for the property. Considering the cumulative depreciation on the property the adjusted basis is 440000 540000 old adjusted basis minus 100000 cumulative depreciation. Total Square Footage. Original basis or purchase price. Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation.

Source: bankrate.com

Source: bankrate.com

It represents the Cost Basis that has been adjusted over time either through increases andor decreases to basis. Add the cost of major improvements. Original basis or purchase price. Most non-registered investments require an adjusted cost base calculation. It represents the Cost Basis that has been adjusted over time either through increases andor decreases to basis.

Source: thetaxadviser.com

Source: thetaxadviser.com

The adjusted basis of an asset is generally its purchase price plus capital improvements and costs of sale less any tax deductions you previously took for the property. It represents the Cost Basis that has been adjusted over time either through increases andor decreases to basis. Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset. Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation. Cumulative capital improvements depreciation.

Source: thetaxadviser.com

Source: thetaxadviser.com

Calculate your adjusted basis by factoring in the change to your investment. The adjusted basis is simply the cost of your home adjusted for tax purposes by improvements youve made or deductions youve taken. Common expenses that reduce an. The higher your adjusted basis is the less youll pay in the. An assets adjusted basis takes the base price of an asset and adjusts it for changes in value reflecting enhancements and or depreciation.

Source: slideshare.net

Source: slideshare.net

Common expenses that reduce an. Adjusted basis of home sold. Adjusted Basis and Basis are terms often used interchangeably by CPAs and tax professionals. Add the cost of major improvements. 8 L x 5 H 40SF Converting SF to Acres.

Source: novelinvestor.com

Source: novelinvestor.com

Cumulative capital improvements depreciation. Top Length Bottom Length 2 x Height Area Steps. To calculate an assets or securitys adjusted basis you simply take its purchase price and then add or subtract any changes to its initial recorded value. Original basis or purchase price. Cumulative capital improvements depreciation.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title adjusted basis formula real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.