Your 7 tax strategies every real estate agent should know images are ready. 7 tax strategies every real estate agent should know are a topic that is being searched for and liked by netizens today. You can Get the 7 tax strategies every real estate agent should know files here. Find and Download all free photos and vectors.

If you’re looking for 7 tax strategies every real estate agent should know pictures information related to the 7 tax strategies every real estate agent should know keyword, you have come to the right site. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

7 Tax Strategies Every Real Estate Agent Should Know. Third the Real Estate Professional classification allows taxpayers to deduct 100 of all real estate losses against ordinary income. FREE Archived Webinar. We asked real estate and tax professionals across the country for their very best tax tips. You must spend more time in real estate activities than non-real estate activities.

100 Plus Amazing Real Estate Agent Video Ideas Video Marketing Real Estate Agent Real Estate Rentals From pinterest.com

100 Plus Amazing Real Estate Agent Video Ideas Video Marketing Real Estate Agent Real Estate Rentals From pinterest.com

You mightve heard it said that you shouldnt let the Tax tail wag the dog meaning you shouldnt make investment decisions based on the tax. Adding in Personal Property 3. Anyone who moves must be sure to update their address with the IRS. Where many new agents make a mistake is in selecting a brokerage based only on money issues. What Every Agent Should Know Course Outline Continued a. The real estate field offers its own set of tax and compliance challenges.

Often their offer of marketing ad space space on the brokerage website and.

Own Properties in a Self-Directed IRA. We asked real estate and tax professionals across the country for their very best tax tips. A taxpayer must simply be involved in the decision making for the real estate investment and doesnt even require the taxpayer to make a special election on their tax return. Investors cant eliminate market shocks but they can hedge their bets against booms and busts with a diversified portfolio and strategy based on general market. Dont feel like this should be the first priority in tax planning when it comes to real estate. Ill give you an example.

Source: pinterest.com

Source: pinterest.com

What Every Agent Should Know Course Outline Continued a. Over 75 of real estate agents report their income in the worst way possible. However not all tax saving strategies are created equal. Your accountant can help you determine the percentage of the expenses you can deduct but for a rough estimate divide the number of square feet of the home that you use for your real estate business by the total square footage of the home. You understand the basics of the tax efficiencies that come with owning real estate investments.

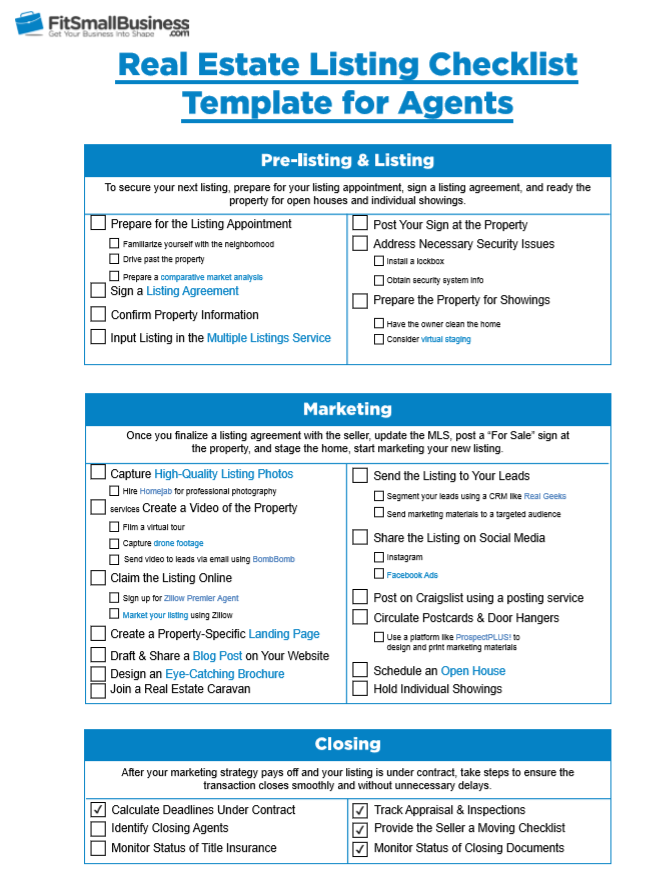

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Often their offer of marketing ad space space on the brokerage website and. Dont forget your mileage Many real estate agents leave money on the table when it comes to their mileage says Thomas J. What you may not know is that you can set up your own self-directed IRA and use it to invest in real estate tax-free. Williams an enrolled agent and tax accountant who operates Your Small Biz Accountant LLC a virtual boutique practice with a focus on rental real estate. FREE Archived Webinar.

Source: blog.graana.com

Source: blog.graana.com

Allocating Purchase Price among Properties Purchased 4. We asked real estate and tax professionals across the country for their very best tax tips. Your accountant can help you determine the percentage of the expenses you can deduct but for a rough estimate divide the number of square feet of the home that you use for your real estate business by the total square footage of the home. Own Properties in a Self-Directed IRA. This postponement applies to individual taxpayers including individuals who.

Source: pinterest.com

Source: pinterest.com

We asked real estate and tax professionals across the country for their very best tax tips. Deductions 1031 exchanges business travel and the like. You must spend more time in real estate activities than non-real estate activities. Depending on where you work on a regular basis the tax. So youve been around the real estate investing block a few times.

Source: pinterest.com

Source: pinterest.com

Luckily the Internal Revenue Service recently announced an extension to file for the 2020 tax year stating. The real estate field offers its own set of tax and compliance challenges. Own Properties in a Self-Directed IRA. However although buying real estate is something every investor should consider being a real estate professional ISNT for everyone. There are countless tax saving strategies real estate investors may implement each and every year not the least of which may help offset income taxes.

Source: br.pinterest.com

Source: br.pinterest.com

Thats where we get involved. FREE Archived Webinar. Tax-Saving Strategies for Real Estate Investors 1. Most self-employed real estate professionals forego valuable deductions out of uncertainty or fear of filing incorrectly and triggering an IRS audit. For busy real estate agents who manage their own finances it can be hard to find time and energy to get expenses in order.

Source: pinterest.com

Source: pinterest.com

However not all tax saving strategies are created equal. Leave more money to your heirs. FREE Archived Webinar. Are you overpaying on your taxes. All markets have ups and downs tied to the economy interest rates inflation or other market trends.

Source: pinterest.com

Source: pinterest.com

It involves more than just the commission splits. This classification only helps WHEN you have multiple rental properties and you make more than 150000 a year in Adjusted Gross Income. Here are eight risk factors investors should consider when evaluating any private real estate investment. In particular these five tax savings strategies have become the most coveted. Thats where we get involved.

Source: pinterest.com

Source: pinterest.com

Most self-employed real estate professionals forego valuable deductions out of uncertainty or fear of filing incorrectly and triggering an IRS audit. Heres what they said. Adding in Personal Property 3. Four Tax Tips Every REALTOR Should Know. Youre probably familiar with IRAs and Roth IRAs as a tax-deferred way to invest for retirement.

Source: pinterest.com

Source: pinterest.com

FREE Archived Webinar. Depending on where you work on a regular basis the tax. The real estate field offers its own set of tax and compliance challenges. Williams an enrolled agent and tax accountant who operates Your Small Biz Accountant LLC a virtual boutique practice with a focus on rental real estate. You mightve heard it said that you shouldnt let the Tax tail wag the dog meaning you shouldnt make investment decisions based on the tax.

Source: pinterest.com

Source: pinterest.com

Own Properties in a Self-Directed IRA. Dont forget your mileage Many real estate agents leave money on the table when it comes to their mileage says Thomas J. A taxpayer must simply be involved in the decision making for the real estate investment and doesnt even require the taxpayer to make a special election on their tax return. Dont feel like this should be the first priority in tax planning when it comes to real estate. For busy real estate agents who manage their own finances it can be hard to find time and energy to get expenses in order.

Source: investfourmore.com

Source: investfourmore.com

You mightve heard it said that you shouldnt let the Tax tail wag the dog meaning you shouldnt make investment decisions based on the tax. Here are eight risk factors investors should consider when evaluating any private real estate investment. You must spend more time in real estate activities than non-real estate activities. If youve begun investing in real estate whether through crowdfunding or other passive income strategies it pays to know about the many tax benefits like these. Possibility of Double Tax Penalty 5.

Source: blog.graana.com

Source: blog.graana.com

This is because. Youre probably familiar with IRAs and Roth IRAs as a tax-deferred way to invest for retirement. Chris is a former IRS agent with over 30 years of tax. Third the Real Estate Professional classification allows taxpayers to deduct 100 of all real estate losses against ordinary income. You mightve heard it said that you shouldnt let the Tax tail wag the dog meaning you shouldnt make investment decisions based on the tax.

Source: pinterest.com

Source: pinterest.com

Investors cant eliminate market shocks but they can hedge their bets against booms and busts with a diversified portfolio and strategy based on general market. However not all tax saving strategies are created equal. Your accountant can help you determine the percentage of the expenses you can deduct but for a rough estimate divide the number of square feet of the home that you use for your real estate business by the total square footage of the home. You have to spend at least 750 hours per year in real estate activities. Not only do we understand the tax issues you face we know the real estate.

Source: de.pinterest.com

Source: de.pinterest.com

FREE Archived Webinar. Leave more money to your heirs. I am currently working with a successful agent who netted 259197 after all the write-offs we come up with for him. According to CPA Mark Kohler in 7 Tax Strategies Every Real Estate Agent Should Know an S corporation can reduce your self-employment tax by allowing you to. In particular these five tax savings strategies have become the most coveted.

If youve begun investing in real estate whether through crowdfunding or other passive income strategies it pays to know about the many tax benefits like these. Third the Real Estate Professional classification allows taxpayers to deduct 100 of all real estate losses against ordinary income. Williams an enrolled agent and tax accountant who operates Your Small Biz Accountant LLC a virtual boutique practice with a focus on rental real estate. Deductions 1031 exchanges business travel and the like. The real estate field offers its own set of tax and compliance challenges.

Source: pinterest.com

Source: pinterest.com

There are countless tax saving strategies real estate investors may implement each and every year not the least of which may help offset income taxes. I am currently working with a successful agent who netted 259197 after all the write-offs we come up with for him. You mightve heard it said that you shouldnt let the Tax tail wag the dog meaning you shouldnt make investment decisions based on the tax. Money Money Money. You have to spend at least 750 hours per year in real estate activities.

Source: investfourmore.com

Source: investfourmore.com

This classification only helps WHEN you have multiple rental properties and you make more than 150000 a year in Adjusted Gross Income. There are countless tax saving strategies real estate investors may implement each and every year not the least of which may help offset income taxes. 11 Tax Deductions Every Real Estate Agent Should Know About. Heres what they said. Money Money Money.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 7 tax strategies every real estate agent should know by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.